Do you feel like your paycheck disappears the moment it hits your bank account? Managing finances can be stressful, especially when unexpected expenses crop up. That’s where budgeting comes in, and with modern tech, it’s easier than ever. Enter Every Dollar, a savvy, user-friendly budgeting app designed to take the guesswork out of managing money.

Created by Ramsey Solutions, Every Dollar helps you plan your spending, track expenses, and achieve your financial goals more effectively. This guide will walk you through how to use Every Dollar, from basic setup to advanced tips for hitting long-term targets. Whether you’re a budgeting newbie or a financial pro, the app has something for everyone!

How Every Dollar Can Help You Master Your Finances

Every Dollar is more than just a budgeting tool, it’s a roadmap to financial success. By leveraging its features to cut expenses, increase savings, and avoid common pitfalls, you can take control of your finances with confidence.

1. It Gives You a Clear Snapshot of Your Finances

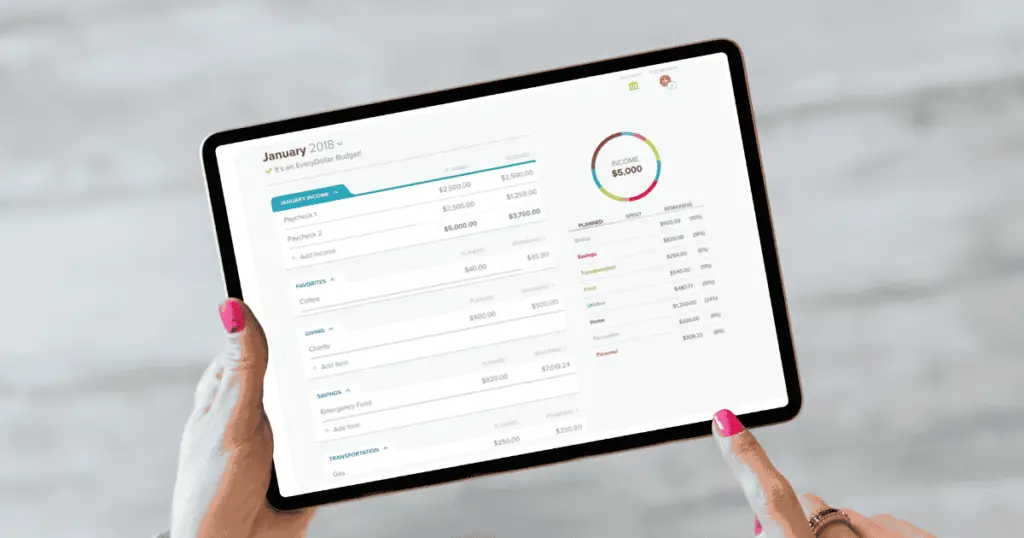

One of Every Dollar’s biggest strengths is its ability to provide a clear snapshot of your financial habits. By tracking your income and expenses, you can quickly identify areas where you might be overspending and adjust accordingly.

This level of awareness allows you to make smarter financial decisions, ensuring that more of your money goes toward achieving your goals rather than unnecessary expenses.

2. It Provides Strategies for Cutting Expenses

A key aspect of effective budgeting is learning where to cut unnecessary costs. Every Dollar helps you analyze spending patterns and pinpoint areas where you can reduce expenses without sacrificing your quality of life.

Some strategies include:

- Eliminating unused subscriptions: The app helps track recurring expenses, allowing you to cancel subscriptions you no longer need.

- Reducing impulse purchases: With a clear view of your financial priorities, you can make more intentional spending decisions.

- Optimizing grocery and utility spending: By setting category limits, you can find ways to save on everyday essentials.

3. It Enables You to Increase Savings With Intentional Budgeting

Every Dollar’s ability to connect directly to your bank accounts allows you to track and manage transactions in real-time. This seamless integration eliminates the need for manual data entry, ensuring that your budget stays accurate and up to date effortlessly.

Additionally, it enables you to allocate more funds toward savings goals by:

- Automatically setting aside money for an emergency fund: Prioritizing savings ensures financial security in unexpected situations.

- Creating sinking funds for future expenses: Save gradually for large purchases like vacations, home repairs, or holiday gifts.

- Tracking progress on financial milestones: The app keeps you accountable by displaying progress toward your goals.

4. It Can Help You Avoid Common Budgeting Mistakes

Even with the best intentions, budgeting mistakes can derail financial progress. Every Dollar helps you avoid these pitfalls by offering structured guidance and real-time updates.

Some common mistakes it helps prevent include:

- Underestimating expenses: The app ensures all spending categories are accounted for, reducing the risk of unexpected shortfalls.

- Failing to adjust the budget regularly: Life circumstances change, and Every Dollar makes it easy to update your budget accordingly.

- Not assigning every dollar a purpose: With its zero-based budgeting approach, the app ensures all income is allocated, eliminating wasteful spending.

5. It Assists You Master Your Finances with Zero-Based Budgeting

At its core, Every Dollar uses a zero-based budgeting approach. This means every dollar of your income is assigned a purpose. This method promotes financial discipline by ensuring that your money is correctly accounted for, whether it’s covering essentials, saving for the future, or paying down debt.

6. It Allows You To Follow a Step-by-Step Financial Plan with Baby Steps

For those looking for a step-by-step path to financial success, Every Dollar’s “Baby Steps” feature is a game-changer. It guides you through key financial milestones, from building an emergency fund to becoming debt-free and saving for retirement.

By following this structured approach, you can create a solid financial foundation and work toward long-term stability.

A Step-by-Step Guide to Using the Every Dollar App for Better Budgeting

Using Every Dollar for budgeting is simple and straightforward:

Step 1: Set Up an Account

Download and Create an Account

To get started, download the Every Dollar app from the Apple App Store or Google Play Store, or access it directly through the web. Once installed, sign up by entering your name, email address, password, country, state, and ZIP code (Note: Every Dollar is currently available only in the U.S. and Canada).

After completing the sign-up process, you’ll receive a confirmation email. Once verified, you are all set to start budgeting!

Set Your Financial Goal

After registering, the app will prompt you to select a money goal that best fits your financial priorities. You can choose from options such as:

- Saving for retirement

- Paying off debt

- Breaking the paycheck-to-paycheck cycle

- Funding your child’s education

- Traveling

- Saving for a home

Personalize Your Profile

Next, Every Dollar will ask for a few more details to tailor your experience. You will answer questions about whether you own or rent a home, have children, own a car, or have pets. These insights help the app provide a more personalized budgeting experience.

Sync Your Accounts

If you have Every Dollar Premium (paid version), you can sync your bank accounts with money and expenses categories. This way, the accounts automatically update themselves.

Step 2: Input Your Income

Now that your account is set up, it’s time to enter your monthly income. This includes your regular paychecks as well as any extra earnings from side hustles, freelance work, bonuses, etc. Every Dollar follows a zero-based budgeting system, meaning every dollar you earn is assigned a specific purpose, ensuring you’re in full control of your finances.

Here’s how you enter your income in Every Dollar:

- Click “Add Income.”

- Label your income: use descriptions like Paycheck 1, Paycheck 2, Side Hustle Money, or even your employer’s name, whichever works best for you.

- Tab the planned amount and input the estimated amount you expect to receive.

- Repeat this process for all sources of income, including your spouse’s income if applicable.

NOTE: If you have an irregular income source, simply enter the lowest expected amount for the month. And use the new paycheck planning feature in the Every Dollar Premium version. It makes budgeting easier for those with irregular incomes

Step 3: List Your Expenses

Now that you have planned for your incoming money, it’s time to map out where your money will go. This step is all about listing your expenses.

Start with the Essentials. For instance, before diving into bills and other expenses, prioritize giving and saving. If you follow the 10% giving rule, set that aside first. If you don’t have an emergency fund yet, make building one a priority.

Next, focus on covering your “Four Walls”: food, utilities, shelter, and transportation. Essentially, this means making sure you have enough to feed your family, keep the lights on, pay your rent or mortgage, fuel your car, and ensure your vehicle runs smoothly. In Every Dollar, you’ll find these under Housing, Transportation, and Food categories. Add specific budget lines for each expense by clicking “Add Item.” You can even use emojis to make it more fun!

Once you have covered the essentials, move on to listing other monthly expenses. This includes things like insurance, debt payments, and childcare. You’ll also want to include a category for miscellaneous spending and any fun money you allocate for entertainment. In Every Dollar, these categories are labeled Personal, Lifestyle, Health, Insurance, and Debt. Again, create the budget lines you need under each. Begin with fixed expenses, then estimate the rest based on past spending.

NOTE: If you’re paying off debt, cut back on non-essentials like dining out or entertainment. Every extra dollar should go toward eliminating debt. Why? Because debt keeps you stuck in the past, paying for things you’ve already bought instead of moving forward financially. Once you’re debt-free, you’ll have more control over your money.

Step 4: Assign Every Dollar a Job

Now it’s time to allocate your income across all your expenses and savings categories.

For each category, input your “Planned” amount: This is your initial budget allocation. You can adjust this later if needed, but it’s important to set up your preset budgets for each category first. Every Dollar provides eight main spending categories, but you also have the option to create custom ones. Plus, you can set up “Funds,” which are essentially savings goals, such as building an emergency fund.

NOTE: Within each category, you can draft notes, track expenses, or even mark it as “Favorite for quick access if you will be updating that category frequently.

Next to the “Planned” amount for each category is the “Remaining” column, which shows how much is left in your budget. You can toggle between “Remaining” and “Spent” to track how much of your budget you have used.

The goal is this step is to create a zero-based budget. This means your income minus your expenses should add up to zero. For example, if you make $10,000 a month, every penny of that should be assigned to a specific job. If you find that you have unallocated funds, consider increasing debt payments and boosting your savings.

To help you know when you have reached zero, Every Dollar proudly displays a “Zero-based Budget” banner at the top of the screen once you have assigned every dollar.

Step 5: Track Your Transactions

Expense tracking is key to staying accountable, both to yourself and your financial goals. If you are married, it is even more important to share the same Every Dollar account, ensuring you and your partner are on the same page with your budget.

Don’t wait until the end of the month to check your spending. Track your transactions regularly so you can make adjustments before you overspend. This habit is one of the most important steps in maintaining control over your finances.

It is easy to do this in Every Dollar. Just click the Transactions icon, tap the plus button, enter the details, and assign the expense to the right budget category. You can track purchases as they happen, daily, weekly, or whatever rhythm keeps you consistent and prevents you from forgetting!

Advanced Tips and Tricks for Getting the Most Out of Every Dollar

1. Automate Where Possible

Take advantage of automation to simplify budgeting. Set up automatic bill payments and savings transfers to ensure essential expenses and savings goals are met without manual intervention. You can also link Every Dollar to your bank accounts (if using Every Dollar Premium) to track expenses in real-time, reducing the need for manual entries.

2. Periodically Review and Adjust Your Budget

A budget isn’t static, it should evolve with your financial situation. Set a monthly or quarterly reminder to review your budget and make necessary adjustments based on changes in income, expenses, or financial priorities.

Periodic budget reviews can help you identify trends, cut unnecessary spending, and reallocate funds to align with your goals.

3. Integrate Other Financial Planning Tools

Enhance your budgeting strategy by integrating Every Dollar with other financial planning tools. For instance:

- Net worth trackers like Personal Capital can help you monitor your overall financial health.

- Debt repayment calculators can assist in optimizing your debt payoff strategy.

- Investment apps like M1 Finance or Betterment can help you align long-term financial planning with your budget.

4. Maximize the “Baby Steps” Feature

The “Baby Steps” feature is a proven framework for financial success, guiding you through key stages like building an emergency fund, paying off debt, and investing. Leverage this roadmap to stay on track, celebrate milestones, and adjust your strategy as needed.

The seven baby steps include the following:

- Start an Emergency Fund by saving $1000

- Pay off debt using the Debt Snowball

- Save 3 to 6 months of expenses

- Invest 15% of income into retirement

- Save for your kid’s college fund

- Pay off the house

- Build wealth and give to charity

5. Use Spending Categories for Better Insights

Break down your expenses into detailed categories to get a clearer picture of your spending patterns. If you notice overspending in a particular area, set specific spending caps and find ways to cut back without compromising essentials.

6. Plan for Irregular Expenses

Anticipate upcoming irregular expenses (e.g., holidays, car maintenance, insurance premiums) by setting aside funds each month in a sinking fund. This approach prevents financial strain when these costs arise.

Your Next Steps Toward Financial Freedom

In conclusion, Every Dollar is a powerful tool for taking control of your finances. With its user-friendly design, real-time transaction tracking, and zero-based budgeting approach, it simplifies money management and helps you stay on top of your financial goals.

By giving you a clear, detailed view of your income and expenses, Every Dollar empowers you to make smarter financial decisions. Whether you’re just starting your budgeting journey or looking for a more effective system, this app provides the structure and guidance you need.

Are you ready to take charge of your finances? Download the Every Dollar app NOW and start budgeting with confidence. Don’t leave your finances to chance. With Every Dollar, every cent has a purpose.