Managing personal finances can be a daunting task, especially with the myriad of income sources, expenses, and subscriptions modern life throws at us. Enter the Rocket Money budgeting app is designed to simplify personal finance.

Formerly known as Truebill, Rocket Money promises to help you save, track spending, and even cancel unwanted subscriptions with ease. In this Rocket Money review, we will uncover everything you need to know and help you decide whether it’s worth the money.

Table of Contents

- Rocket Money Overview

- How Does Rocket Money Work?

- Key Features of Rocket Money

- Benefits of Using Rocket Money?

- Rocket Money Pricing: How Much Does Rocket Money Cost?

- Rocket Money Ratings & Reviews

- Alternatives to Rocket Money

- Why Wait? Start Saving With Rocket Money Today

Rocket Money Overview

Rocket Money is a personal finance app designed to simplify budget management by bringing all your accounts into one place. It helps you track spending, monitor savings, and even cancel unused subscriptions effortlessly.

Competing with popular budgeting apps like Quicken Simplifi, YNAB (You Need a Budget), and Trim, Rocket Money stands out with its subscription management and expense-cutting features. This feature, along with its expense-tracking and budgeting tools, has attracted over 3.4 million happy users and counting.

The app has also been featured in major publications like Forbes, The New York Times, and The Wall Street Journal and has been downloaded more than two million times.

How Does Rocket Money Work?

Rocket Money works similarly to other personal finance apps. To get started, download the app on Android or iOS and create an account.

Next, securely link all your financial accounts such as checking, investments, credit cards, and savings. This integration allows you to monitor your entire financial picture from a single dashboard.

Rocket Money uses Plaid to connect to your accounts without storing or accessing your login credentials, ensuring your data remains protected.

Once all your accounts are linked (which typically takes 10-30 minutes, depending on the number of bank passwords you remember), Rocket Money gets to work. It analyzes your finances to provide insights into your monthly income vs. spending, net worth, and more.

From here, you can:

- Create and track a budget

- Review individual transactions

- Check your latest credit score

Every time you open Rocket Money, the app automatically updates your data, keeping your financial insights fresh and accurate.

Key Features of Rocket Money

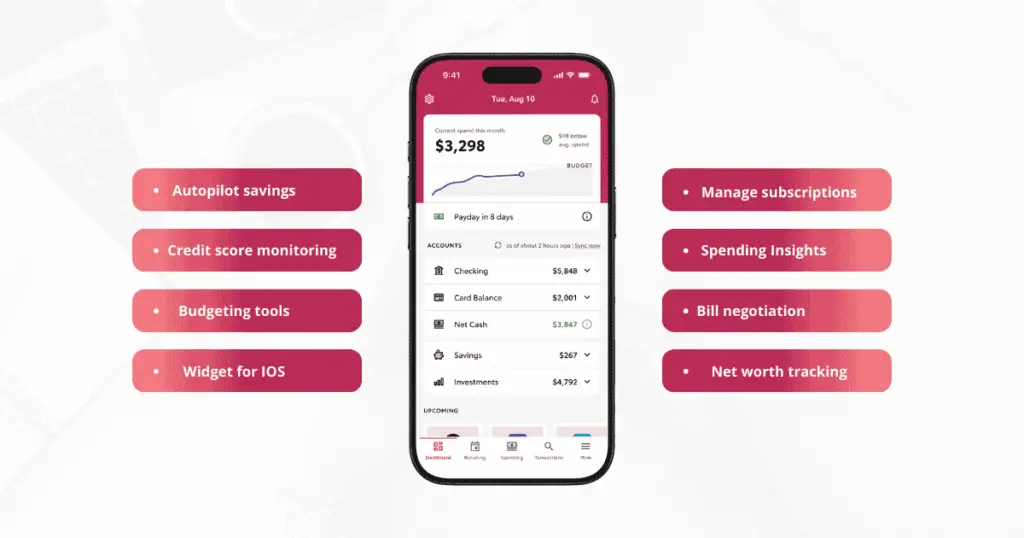

Manage Subscriptions

Take control of your subscriptions with Rocket Money. The app identifies all your recurring payments so you can stop paying for things you no longer need. If you find a subscription you want to cancel, Rocket Money’s concierge service can handle it for you.

Keeping track of subscriptions is difficult, but Rocket Money brings them all together in a single list, helping you stay organized. Users love the recurring view feature, which helps them track upcoming bills, avoid late fees, and pay on time. To date, Rocket Money has canceled nearly 2.5 million subscriptions on behalf of its users.

Spending Insights

Rocket Money provides an effortless breakdown of your finances to help you understand where your money is going. By connecting to your bank accounts, it instantly identifies your top spending categories, allowing you to make smarter financial decisions. With real-time alerts, Rocket Money notifies you about upcoming charges or low balances to help you avoid overdrafts and late fees.

Bill Negotiation

Rocket Money takes the hassle out of lowering your bills. By automatically scanning your bills for savings, the app can negotiate lower rates on services like cable, cell phone plans, and even car insurance. If you’re charged overdraft or late fees, Rocket Money guides you through the process of getting a refund.

Net Worth Tracking

Your net worth is a crucial indicator of financial health that most people rarely consider. Rocket Money helps you monitor your net worth effortlessly. The app consolidates all your assets and debts into one view, updating values automatically. You can even add custom assets like a 401(k), a sneaker collection, or a classic car to get a complete picture of your financial standing.

Autopilot Savings

Rocket Money makes saving money effortless with its Financial Goals feature. The app analyzes your spending habits to determine the optimal time to save, ensuring you reach your goals faster while avoiding overdraft fees. Your savings are stored in an FDIC-insured account, giving you peace of mind.

Credit Score Monitoring

Rocket Money provides access to your credit score and history. This offers insights into how various factors affect your score. Real-time alerts notify you of important changes, ensuring you’re always prepared when applying for new credit.

Budgeting Tools

Setting up a budget with Rocket Money is simple and effective. The app automatically tracks spending by category, helping you stay on track toward your financial goals. With real-time alerts, it warns you when you’re approaching your spending limits, ensuring you make informed financial choices.

Widgets for iOS

With a Rocket Money Premium Membership, you gain access to exclusive widgets on iOS. These widgets allow you to monitor upcoming bills, recent transactions, and available spending funds from your home screen.

Benefits of Using Rocket Money?

Managing your finances and budget can feel overwhelming, but Rocket Money makes it easy by giving you the insights and tools to take charge of your financial future.

Save Money Effortlessly

Rocket Money is designed to help you cut unnecessary expenses and boost your savings. One of the best features is that Rocket Money automatically identifies and cancels unused subscriptions. However, the savings don’t stop there. It will help you negotiate lower bills and alert you to duplicate charges or potential fraud.

You can also set up a Smart Savings account, where Rocket Money helps you save without even thinking about it. The autopilot feature analyzes your spending habits and moves small amounts into savings automatically. Over time you can build a financial cushion with minimal effort.

Take Control of Your Spending

With Rocket Money’s budgeting tools, you decide how detailed or high-level you want to go. With categorized expenses, you can target where to cut spending and identify new ways to save.

By tracking your transactions in real-time, Rocket Money helps you stay within budget and adjust spending where needed.

Improve Your Credit Score

Rocket Money provides easy access to your credit score and credit report through Experian®. Unlike traditional reports, Rocket Money breaks down your credit health in a user-friendly way and offers insights to help you improve it. A better credit score can unlock lower interest rates and better financial opportunities.

Track & Grow Your Net Worth

Your net worth is a key indicator of financial health. Rocket Money consolidates all your assets and debts into one view, showing your financial progress over time. You can even add custom assets like collectibles or jewelry to get a complete picture of your wealth.

Rocket Money Pricing: How Much Does Rocket Money Cost?

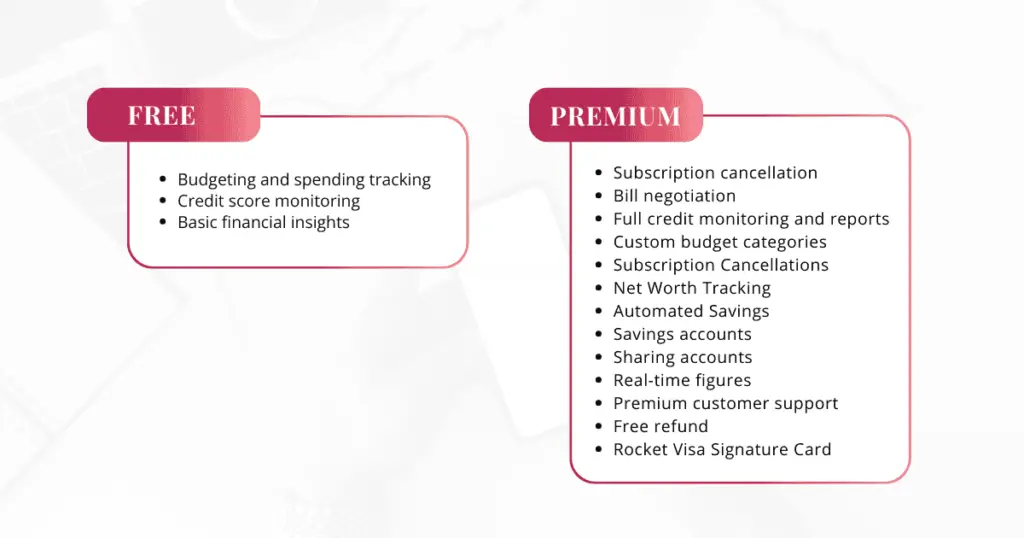

Rocket Money is free to download and offers both free and premium plans, depending on the services and features you need.

The free version includes essential tools such as:

- Budgeting and spending tracking

- Credit score monitoring

- Basic financial insights

However, for those who want more control over their finances, Rocket Money’s premium version includes additional features such as;

- Subscription cancellation

- Bill negotiation. It only charges 30% – 60% of first-year savings if successful.

- Full credit monitoring and reports. (Free plan only provides credit score)

- Custom budget categories

- Subscription Cancellations

- Net Worth Tracking

- Automated Savings

- Savings accounts

- Sharing accounts

- Real-time figures

- Premium customer support

- Free refund

- Rocket Visa Signature Card

Rocket Money’s premium plan operates on a flexible pricing model, allowing users to choose a monthly rate between $6 and $12. New premium members receive a 7-day free trial before being charged the selected amount.

Rocket Money Ratings & Reviews

Rocket Money has received mixed feedback from users. On Trustpilot, it holds an average rating of 4.2/5, with users praising its ability to track subscriptions and provide spending insights. However, some users express frustration over high bill negotiation fees. On Google Play and the App Store, Rocket Money maintains a 4.6-star rating, with many appreciating its intuitive design and financial tracking tools.

Pros of Rocket Money

- Free plan available

- Multiple money management features

- Subscription management

- “Pay what’s fair” scheme on the Premium plan

- Bank-level security

- User-friendly design

- Available on iPhone and Android

Cons of Rocket Money

- Best features require a paid subscription

- Expensive bill negotiation fees

- Credit score monitoring updates only once a month

Alternatives to Rocket Money

1. You Need a Budget (YNAB)

If you’re serious about budgeting and want to break free from living paycheck to paycheck, You Need a Budget (YNAB) is a top contender. It follows a zero-based budgeting system, ensuring every dollar you earn is assigned to a specific purpose.

YNAB isn’t free, but it offers a 34-day trial to test its features. After that, it costs $14.99 per month or $109 annually. The platform provides detailed spending insights, net worth tracking, and financial calculators to help you achieve your money goals. While it requires more hands-on management than Rocket Money, its structured approach is highly effective.

2. Quicken Simplifi

Quicken Simplifi is a strong alternative for those looking for affordable money management. Similar to Rocket Money, Quicken Simplifi includes essential features like account linking, bill tracking, budgeting tools, and savings goals.

Simplifi’s biggest advantage over Rocket Money is its pricing structure. Simplifi costs a flat $3.99 per month (billed annually), which is lower than Rocket Money’s $6–$12 premium range. Plus, there are often discounts for new users. While the interface isn’t as sleek, Simplifi delivers solid budgeting and financial tracking.

Quicken also offers options for freelancers and small business owners. These plans come with additional features like invoicing and tax planning.

3. Monarch Money

If detailed budgeting and financial insights are your priority, Monarch Money is worth considering. It offers comprehensive graphs and charts that break down your income and expenses, providing a clear picture of where your money goes each month.

However, it comes at a higher cost: $14.99 per month or $99.99 annually. While it lacks some of Rocket Money’s automation features, Monarch Money excels in helping users actively manage their finances with precision.

Why Wait? Start Saving With Rocket Money Today

Rocket Money offers a powerful, user-friendly solution for managing your finances with minimal effort. From tracking spending and monitoring subscriptions to negotiating bills and automating savings, it streamlines personal finance in a way that can save you both time and money. While some premium features come at a cost, the potential savings from canceled subscriptions and lower bills often justify the investment.

If you’re looking for an effortless way to take control of your budget without the complexity of manual tracking, Rocket Money is worth considering. However, if you prefer a more hands-on budgeting approach with advanced customization, alternatives like YNAB or Monarch Money may be a better fit. Ultimately, Rocket Money stands out as an excellent choice for those seeking automation, convenience, and financial peace of mind.

Take the first step towards smarter financial management. Try Rocket Money for free and see how much you can save. [Click here to sign up now!]