Buy-now, pay-later services like Afterpay are changing the way customers shop and businesses sell. If you’re a small business owner, understanding this increasingly popular payment method can be the key to driving higher sales.

This guide dives into what Afterpay is, how it works, and how it can be a game-changer for your business.

Afterpay Overview

Afterpay is an Australian fintech company that has become a major player in the fast-growing buy now, pay later (BNPL) industry. By partnering with a diverse network of global brands and local businesses, Afterpay has solidified its position as a preferred checkout method.

At the core of Afterpay’s flagship service is a simple, interest-free installment plan. Customers can split their purchases into four equal payments, with one installment due every two weeks. Unlike some competitors, Afterpay focuses exclusively on short-term repayment options, making it a flexible and transparent choice for consumers looking to manage their budgets without extra costs.

Since its launch in 2014, Afterpay has expanded into markets across North America, Europe, and Oceania, experiencing steady growth along the way. With the Afterpay sector expected to continue its rapid expansion, Afterpay is well-positioned to maintain its leadership. Its commitment to user-friendly experiences and easy-to-integrate technology ensures that both consumers and businesses benefit from its innovative payment solutions.

How Afterpay Works in Small Business

Afterpay partners with retailers, both big and small, to offer short-term financing options. By paying businesses the full purchase amount upfront, Afterpay ensures that companies receive immediate payment while it collects the remaining installment payments directly from customers. This makes it an attractive option for small businesses looking to increase conversions without taking on the risk of financing purchases themselves.

Afterpay’s platform is user-friendly and integrates seamlessly with a business’s existing payment systems, whether online or at the point of sale. To use Afterpay, customers must have a valid credit or debit card and be at least 18 years old. Afterpay tailors customer spending limits according to creditworthiness to promote responsible spending habits.

Here are more details on how paying with Afterpay works:

- Choosing Afterpay at checkout: Whether shopping online or in-store, customers can select Afterpay as their preferred payment method. After entering some basic information, Afterpay instantly provides a spending limit decision, allowing customers to know how much they can spend using the service. These spending limits can vary based on how customers manage their accounts, with limits adjusted after each use.

- Making a purchase: Customers can complete their purchase with Afterpay by paying just 25% of the total price upfront. The remaining 75% is divided into three equal, interest-free installments, due every two weeks. Customers who miss a payment may face a late fee. Meanwhile, small businesses receive the full purchase amount from Afterpay at the time of the transaction, offering them immediate cash flow.

- Returns and refunds: Small businesses are free to set their own return policies for purchases made with Afterpay. This ensures that customer satisfaction and operational flexibility are maintained.

NOTE: Afterpay may report payment history to credit bureaus. This means customers’ use of the service can impact their credit score.

Benefits of Using Afterpay for Your Small Business

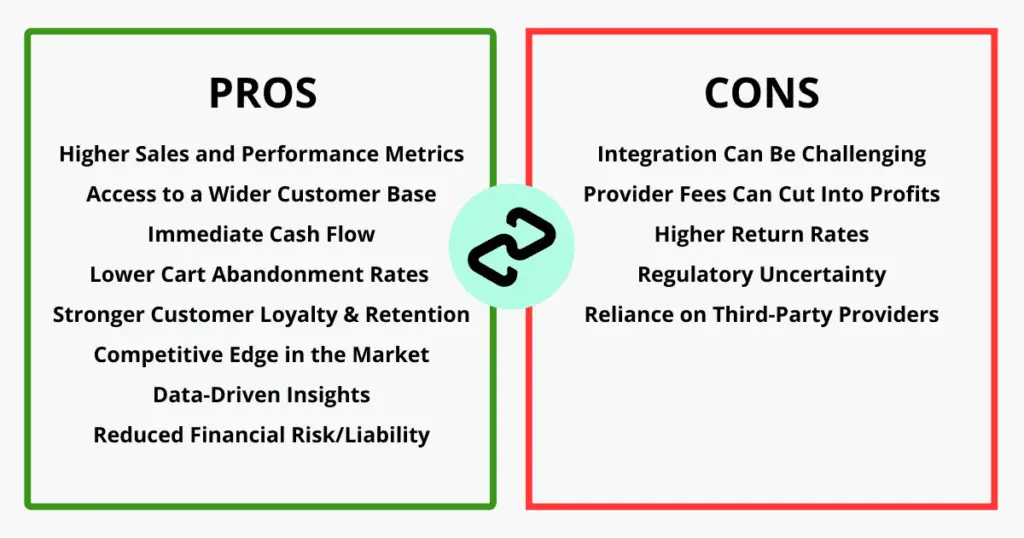

Integrating Afterpay into your payment options can offer significant benefits for small businesses, including the following:

Higher Sales and Performance Metrics

Businesses that offer Afterpay as a payment option often see an increase in sales. In fact, 69% of UK retailers reported improvements in at least one key business metric after integrating solutions like Afterpay.

Afterpay encourages customers to complete their purchases by removing financial barriers, increasing overall revenue.

Access to a Wider Customer Base

By accepting Afterpay, small businesses can tap into a younger, digitally savvy audience, with Gen Z and millennials making up over 80% of Afterpay’s user base. Additionally, high-income earners also use Afterpay, meaning businesses can attract both budget-conscious shoppers and high-spending customers alike. With Afterpay’s anticipated expansion into Africa and Asia, small businesses can further broaden their reach in new and emerging markets.

Immediate Cash Flow

Unlike traditional credit models or layaway programs, Afterpay pays small businesses the full purchase amount upfront while handling installment collections directly from customers. This immediate payment improves cash flow, which is particularly valuable for small businesses that rely on steady revenue.

Lower Cart Abandonment Rates

Cart abandonment is a major challenge for online retailers, with an average abandonment rate of around 70%. By offering Afterpay, small businesses can reduce friction at checkout by making purchases feel more affordable.

Stronger Customer Loyalty & Retention

The flexibility and convenience of Afterpay also encourage repeat business. Studies show that returning customers spend 67% more than first-time buyers, making customer retention a key driver of long-term revenue growth.

Competitive Edge in the Market

In regions where payment plans are still gaining traction, small businesses that accept Afterpay can distinguish themselves from competitors. Consumers increasingly expect flexible payment options, and brands that embrace innovative solutions like Afterpay are often perceived as more customer-friendly and forward-thinking.

Data-Driven Insights

Afterpay gives small businesses detailed analytics on customer behavior, helping them refine product development, marketing strategies, and inventory management. Understanding customer preferences allows for smarter decision-making and targeted promotions.

Reduced Financial Risk/Liability

Since Afterpay takes on the responsibility of collecting payments, small businesses don’t have to worry about managing credit risk. This eliminates the burden of handling unpaid invoices or defaults, making it a safer financial model for small businesses.

Potential Drawbacks of Afterpay for Small Businesses

While Afterpay can provide the above benefits for small businesses, it’s not without its challenges. Before integrating Afterpay, small businesses should carefully consider the following potential downsides.

1. Integration Can Be Challenging

Adding Afterpay to your checkout process may require technical expertise or third-party support, which could result in setup costs. While some e-commerce platforms like PayPal offer built-in payment plan options, others require additional customization. Small businesses may find the time and expense of integration to be challenging, especially if they lack dedicated IT support.

2. Provider Fees Can Cut Into Profits

Afterpay services charge transaction fees that can be higher than traditional credit card fees. These typically include:

- A fixed fee per transaction

- A percentage-based fee on each sale

For small businesses operating on thin profit margins, these fees can add up quickly. If your average order value (AOV) doesn’t increase significantly, the costs of offering Afterpay may outweigh the benefits.

3. Higher Return Rates

Because Afterpay enables frictionless purchases, customers may be more likely to buy impulsively, and then return items later. This is especially common in industries like fashion, where consumers often order multiple sizes or styles, keeping only what they like.

If your small business covers return shipping costs, this can negatively impact your bottom line and increase operating expenses.

4. Regulatory Uncertainty

Short-term lending like Afterpay is becoming more regulated worldwide, and the United States is no exception. As Afterpay’s services grow in popularity, regulatory agencies like the Consumer Financial Protection Bureau (CFPB) are considering new rules to ensure consumer protection.

This could result in:

- Stricter lending requirements for Afterpay providers

- Fewer available payment solutions providers due to regulatory hurdles

- Increased fees or compliance costs for businesses offering loans as payment methods

While regulation could help protect consumers, it might also introduce new costs or complexities for small businesses.

5. Reliance on Third-Party Providers

When using Afterpay, businesses rely on an external company to handle payments and customer financing. This creates a few risks:

- If Afterpay changes its fee structure, businesses must absorb those costs.

- If Afterpay faces financial instability or regulatory pressure, it could impact merchants that rely on its services.

- Technical issues or downtime on Afterpay’s platform could disrupt the checkout process and lead to lost sales.

It is worth noting that businesses that offer Afterpay still retain full control over their payment processing as it is merely an alternative payment method, like PayPal.

How to Add Afterpay to Your Small Business’s Payment System

Integrating Afterpay into your small business can be a game-changer, offering customers a flexible payment option while boosting your sales. This section will explore everything you need to know about integrating Afterpay as a payment method in your small business

Key Requirements for Afterpay Integration

Small businesses must meet the following legal and technical requirements to be able to work with Afterpay:

Legal and Compliance Considerations

To qualify for Afterpay, your small business must:

- Be officially registered and hold proper licenses in all regions where it operates.

- Comply with applicable tax laws and financial regulations.

- Follow data privacy laws such as the CCPA (California Consumer Privacy Act) and the General Data Protection Regulation (GDPR).

Technical Requirements

For seamless integration of Afterpay, your small business must ensure:

- E-commerce platform compatibility: Your small business must have a compatible online store. Afterpay provides plugins and APIs for popular e-commerce platforms like Shopify, WooCommerce, and Magento, allowing businesses to connect Afterpay’s payment gateway to their online store with ease.

- Stable internet connectivity: A reliable internet connection will ensure smooth and secure transaction processing with Afterpay

- PCI DSS compliance: To protect customer payment data, businesses must adhere to Payment Card Industry Data Security Standard (PCI DSS) regulations.

Steps to Get Started with Afterpay

Step 1: Submit an Online Application

Begin by filling out Afterpay’s secure online application form, providing details about your business, financial standing, and proof of identity. Afterpay’s team will review your application and notify you of their decision within a specific time frame.

Step 2: Set Up Your Merchant Account

If approved, you’ll need to register with Afterpay to create a merchant account. During this stage, Afterpay may assess your business’s financial stability.

Once your account is created, you’ll activate it to start processing payments.

Step 3: Integrate Afterpay into Your Checkout System

Next, you’ll integrate Afterpay into your payment systems to add this payment method to your checkout processes both online and in stores. Small businesses can either:

- Use prebuilt plugins for platforms like Shopify or WooCommerce for quick integration.

- Implement Afterpay’s APIs for a more customized payment setup, depending on your technical capabilities and business needs.

Step 4: Conduct Pre-Launch Testing

Before officially launching Afterpay as a payment option, it’s a good idea to test the system to ensure smooth transactions. Additionally, verify that Afterpay supports your business’s required currencies and regions.

Why Your Small Business Should Consider Afterpay

For small businesses striving to grow, Afterpay offers a unique way to attract more customers and improve cart abandonment rates. While it’s not without challenges, understanding how to manage fees and customer communication can unlock its full potential.

If you’re ready to explore the benefits of Afterpay and see how it can transform your business, start the integration process today.

Already using Afterpay? Share your experience in the comments below, we’d love to hear your success stories!