Let’s face it, young people rarely use checks. However, they are still widely used to conduct financial transactions. From writing checks to ensuring they’re processed correctly, there’s a lot to learn. One of the most important (and surprisingly common) skills you need to master is how to void a check. Whether you’re setting up direct deposit or made a mistake, it is essential to understand how to void a check.

This blog will break down everything you need to know about voiding a check, including when to do it, why it’s important, and how to avoid common mistakes. You’ll also find practical examples to help you feel confident managing checks in your financial life.

What Does It Mean to Void a Check?

A check is a one-time payment tool that allows the payee to withdraw the specified amount from your bank account. Each check contains printed account numbers that banks use to facilitate the transfer of funds to the recipient.

Voiding a check simply means writing the word “VOID” across it. This prevents the check from being used for any financial transactions, even if it falls into the wrong hands.

While a voided check cannot be cashed or deposited, it still serves an important purpose in our financial systems. Voided checks are often used to securely provide banking details for setting up direct deposits, automatic payments, or electronic transfers. A voided check provides the recipient with a copy of your account and routing number without the risk of unauthorized use.

When Might You Need to Void a Check?

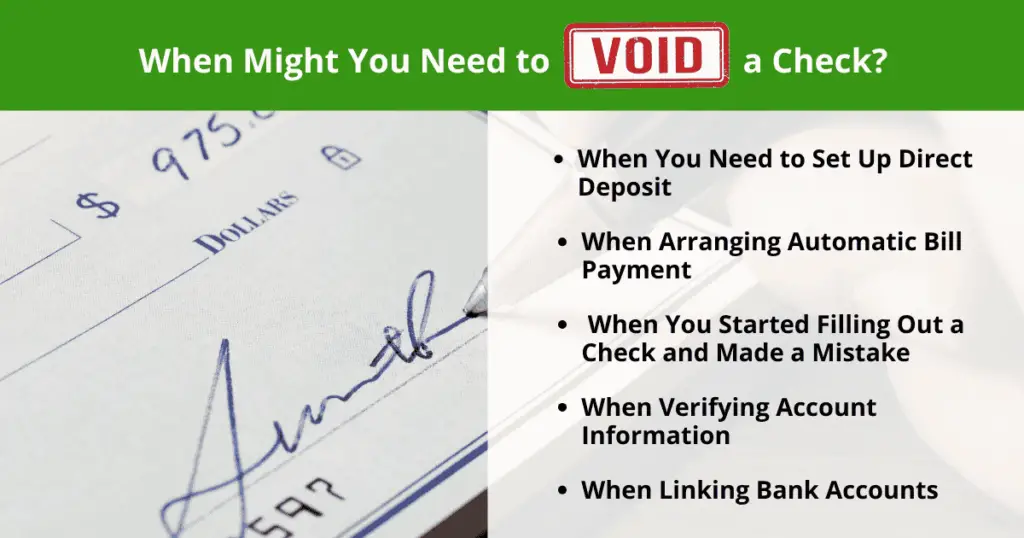

Understanding when a voided check is needed can help both individuals and businesses manage their financial transactions smoothly and securely. Here are some common situations where a voided check may be required:

When You Need to Set Up a Direct Deposit

If you want your paycheck or government benefits to be deposited directly into your bank account, you will need to set up direct deposit. To ensure the funds are sent to the correct account, your employer or government agency requires accurate banking details.

A voided check is one of the sure-fire ways to provide this information. Even though the check cannot be used for transactions, it still contains information such as your bank’s name, address, routing number, and account number, all in one place. This helps prevent errors and ensures your payments are processed smoothly.

When Arranging Automatic Bill Payments

Many people rely on automatic bill payments to manage recurring expenses like utility bills, rent or mortgage, car payments, loan repayments, subscription services, insurance, and IRA contributions.

To set up these payments, companies may request a voided check to ensure they have the correct bank account on file. The account details listed on the check are then entered into a computer system to process an ACH transfer.

When You Started Filling Out a Check and Made a Mistake.

If you accidentally misspell the payee’s name or write “five thousand” instead of “five hundred” on the amount line, crossing it out and correcting it may lead to the bank rejecting the check. Play it safe and avoid confusion and delays by voiding the check and starting fresh.

By writing “VOID” across the check, you clearly indicate that it was a mistake and should not be used for any transactions. This simple step helps prevent any mix-ups and ensures the check is not processed.

When Verifying Account Information:

Service providers and financial institutions sometimes require verification of your bank account details before finalizing an agreement. This can happen when applying for a loan, opening an investment account, leasing an apartment, or requesting a tax refund.

A voided check provides a simple and secure way to confirm that you own the account and that the provided information is accurate. Since the check cannot be used for transactions, it eliminates any risk of unauthorized withdrawals while ensuring a smooth verification process.

When Linking Bank Accounts

If you’re linking two bank accounts, such as a checking and a savings account, especially with a credit union or an online bank, a voided check may be required. This helps verify your account details and ensures that electronic transfers between your accounts are processed securely, accurately, and seamlessly.

How to Properly Void a Check

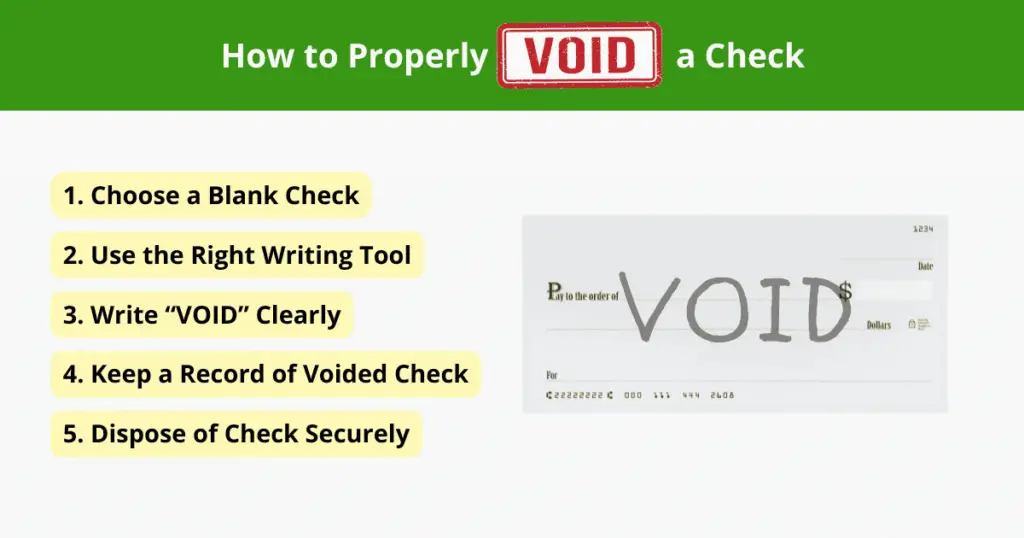

The goal of voiding a check is to make it impossible for someone to use it fraudulently. If the check ever reaches your bank, it should be immediately clear that it has been rendered void. Fortunately, the process of voiding a check is simpler than you may think. You only need to follow these steps:

Step 1: Choose a Blank Check

Start by selecting a blank check from your checkbook. Ensure it has not been filled out or signed, as an already processed check may cause confusion or be misused.

If the check has already been processed, including through mobile deposit, you don’t need to void it. In fact, many checks actually have a box on the back you can check off after making a mobile deposit. Voiding a check after using mobile deposit may lead to issues if the bank requests it later.

Step 2: Use the Right Writing Tool

Grab a pen with blue or black ink. These colors are easily visible and permanent. Other color inks may not show up correctly on the check. Avoid using pencils or erasable ink, as they can be easily tampered with or erased.

Step 3: Write “VOID” Clearly

Using your pen, write the word “VOID” in large, bold letters across the front of the check. Make sure it covers most of the check but does not obscure the bank account and routing numbers at the bottom. These numbers will still be needed to identify your account.

For added security, you can also write “VOID” in smaller print on key areas of the check, such as on the date line, payee line, signature line, and in the amount box.

NOTE: Never sign or endorse a voided check. Signing it may lead to misuse, so leave the signature line blank.

Step 4: Keep a Record of the Voided Check

To track your transactions, make a note of the voided check in your check register or a financial spreadsheet. This entails recording the check number and the date it was voided. If you use duplicate checks, ensure the void marking is visible on the carbon copy as well.

You may also consider scanning the voided check or taking a picture with your phone. This helps you keep a digital record in case you need proof later.

Step 5: Dispose of the Check Securely

Since the check contains sensitive financial information, dispose of it properly to prevent identity theft. Some people recommend shredding the voided check, which is a good idea if it was simply a mistake.

Common Mistakes to Avoid When Voiding a Check

As you have seen above, voiding a check is a straightforward process, but small mistakes can lead to confusion or security risks. To avoid potential issues, be mindful of the following common errors:

- Not making ‘VOID’ clear enough: Writing ‘VOID’ too lightly or in small letters may not effectively prevent fraud. A check that is only partially voided or faintly marked can still be mistaken for an active check. To avoid this, write ‘VOID’ in large, bold letters across the front, ensuring it is immediately noticeable.

- Failing to record the voided check: Not noting the voided check in your records can cause confusion when balancing your checkbook or reviewing bank statements. Missing check numbers may leave you second-guessing transactions.

- Throwing away instead of destroying: Even though the check is voided, it still contains sensitive information like your account and routing numbers. If discarded carelessly, it could be used for identity theft or fraudulent purposes. Always shred voided checks before disposal.

- Covering important details: When voiding a check, avoid marking over the account and routing numbers, as they may still be needed for reference.

- Using a pencil or erasable ink: Always use permanent ink to void a check. Pencil or erasable ink can be altered, leaving you at risk.

- Voiding the wrong check: Double-check the check number before voiding to avoid errors that could impact your financial records.

- Not keeping a copy: If you are voiding a check to set up direct deposits or payments, keep a copy for your records to prevent any issues later.

Alternatives To Voiding a Check

With the rise of digital banking, writing physical checks has become increasingly rare. In fact, many people no longer own a checkbook. However, there are still situations where you may be required to provide a voided check. If you don’t have one, consider these alternatives:

Request a Counter Check from Your Bank

Visit your bank in person and ask for a counter check, also known as a starter check. Some banks provide these for free, while others may charge a small fee. Once you receive it, void it just as you would a regular check.

Remember that not all organizations accept counter checks, so confirm their acceptability beforehand.

Use a Direct Deposit Authorization Form

Many employers and organizations provide their own forms for setting up direct deposits or automatic payments. These forms typically require your bank’s name, account number, and routing number. You can find these details on your bank’s online portal or in your bank statements. This method is widely accepted and helps reduce errors.

Obtain a Bank Letter

You can request an official letter from your bank confirming your account details. This letter should include:

- Your name

- Bank’s name and address

- Your routing number

- Your account number

Some banks may charge a fee for this service, but it is a reliable alternative to a voided check and is commonly accepted. Plus, you won’t have to wait around for checks to be printed.

Provide a Deposit Slip

A deposit slip from your checkbook or local bank branch contains your account and routing numbers. If you don’t have one, your bank may be able to provide a blank deposit slip upon request. Many organizations accept this as a substitute for a voided check.

Use Online Banking Information

Some organizations allow you to submit a screenshot or printout from your online banking portal, displaying your name, account number, and routing number. Ensure you use a secure connection when accessing this information online.

Some companies actually allow you to enter your own account information for payroll services. Payroll providers such as Gusto and Quickbooks are now offering this capability. Other services may integrate with third-party applications like Plaid to verify and share your account details securely.

Check Voiding Is a Must for Finance Beginners

Voiding checks might seem like a minor skill, but understanding how checks work is not fully understood by many people. The ability to void a check properly ensures that your money and personal information remain secure.

Mastering tasks like voiding checks is one step closer to mastering finances. Have you had any experiences where voiding a check saved the day? Share your story or ask our community about tips for smarter financial management!