Health insurance has long been marketed as a must-have for every responsible adult. But does everyone truly need health insurance? Is it conceivable that, under certain circumstances, opting out might be an acceptable choice?

For some individuals, particularly young, healthy adults, the prospect of skipping health insurance is something they may entertain. However, while it might seem like a good way to save money in the short term, it comes with significant financial risks.

This blog will help you weigh the pros and cons of forgoing traditional health coverage. We’ll explore who might consider going without insurance, the alternatives available, the risks involved, and ways to mitigate them if you choose to go uninsured.

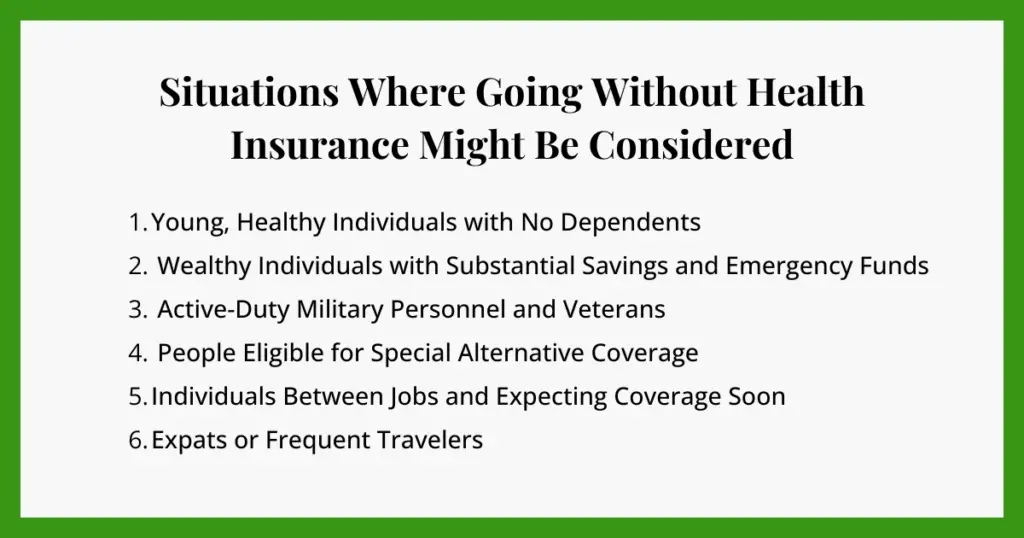

Situations Where Going Without Health Insurance Might Be Considered

Health insurance is generally recommended to cover medical expenses, and at one time, it was legally mandated. But let’s be frank, health insurance in the US is crazy expensive, and there are many situations where individuals may feel they don’t need it or simply cannot afford it. Here are some groups who might consider it OK not to have health insurance

Young, Healthy Individuals with No Dependents

If you are in your 20s or early 30s, in good health, and have no chronic conditions, your immediate medical expenses might be low. Some individuals in this group opt to skip insurance in favor of paying out-of-pocket for occasional doctor visits.

However, it is important to consider potential risks and the rising cost of healthcare. For instance, if you fall and break a leg, you could be left with a pile of medical debt.

Wealthy Individuals with Substantial Savings and Emergency Funds

Those with significant financial resources may choose to self-insure. If you can comfortably afford major medical expenses and emergencies without jeopardizing your financial stability, you might see health insurance as unnecessary.

However, high-net-worth individuals have the most to lose if they end up with large amounts of medical debt. Keep in mind that hospital stays can quickly skyrocket into the hundreds of thousands of dollars. Surgery costs are also extremely high and could wipe out the savings of even a very wealthy individual.

Active-Duty Military Personnel and Veterans

Individuals covered by government healthcare programs such as TRICARE, the Veterans Affairs (VA) system, or similar programs may not require additional private health insurance. However, family members may still need to get their own policies.

People Eligible for Special Alternative Coverage

Some individuals qualify for free or subsidized healthcare coverage through government programs, professional associations, religious health-sharing plans, or employer-funded healthcare stipends.

The most common examples are Medicare and Medicaid. Medicare is a government-run healthcare program for seniors. Eligibility typically starts at age 65, but there are certain extenuating circumstances that could allow you to get it sooner.

Medicaid is available to people who are below a specified percentage of the poverty level. While Medicaid is a federally funded program, eligibility actually varies by state, which makes it a bit confusing.

Individuals Between Jobs and Expecting Coverage Soon

Some individuals choose to go without insurance during short gaps between jobs, particularly if they expect to regain employer-sponsored coverage soon. However, short-term insurance or other alternatives may be a safer option during this period.

COBRA is available for people who lose health insurance coverage and is meant to serve as a short-term option. However, COBRA is very expensive and is not a great solution unless you have no other alternatives.

Expats or Frequent Travelers

Individuals who spend extended periods abroad may choose to forgo domestic health insurance and instead invest in international or travel health policies in countries where healthcare is more affordable. These plans can provide coverage across multiple countries and may be more cost-effective

What Happens If You Don’t Have Health Insurance?

Health insurance is a crucial safety net that provides access to necessary medical care. But what happens if you don’t have health insurance? Let’s take a closer look at the potential consequences.

You Could Face High Medical Bills

One of the most immediate consequences of not having health insurance is the risk of overwhelming medical expenses. Without coverage, any illness, injury, medical emergency care, surgery, or hospital stay could leave you facing from several thousand to hundreds of thousands of dollars in out-of-pocket costs.

That could lead to medical debt or even personal bankruptcy. In fact, medical debt is the number one reason people file for bankruptcy in the US.

To avoid these financial hardships, consider exploring affordable healthcare options such as health-sharing plans, short-term insurance, discount medical plans, Medicaid, Medicare, or subsidized marketplace plans. These options can provide financial protection and peace of mind in times of unexpected illness or injury.

Delayed or Skipped Preventive Care

Health insurance often covers preventive services, such as vaccines, screenings, and annual wellness visits, at no extra cost. Without coverage, these essential services can become expensive, leading many people to delay or skip them entirely. A report by KFF found that nearly one in four uninsured adults (24%) skipped necessary medical care due to cost concerns.

Unfortunately, delaying or skipping preventive care increases the risk of serious health conditions going undetected until they become more difficult and costly to treat.

You May Pay the Individual Mandate Penalty (in Some States)

Although the federal government removed the individual mandate penalty for not having health insurance in 2019, some states still enforce their own mandates. If you live in Vermont, Rhode Island, New Jersey, Massachusetts, or California, being uninsured could result in a financial penalty. It doesn’t take much to stay compliant. A quick look into health insurance companies in florida might be all you need to get yourself set up. It can be that easy!

The amount of penalty varies depending on your state’s regulations and is usually calculated as either a percentage of your income or a fixed dollar amount, whichever is greater. To avoid unexpected costs, check your state’s requirements and ensure you’re covered.

Difficulty Accessing Certain Types of Care

Without health insurance, scheduling specific treatments or elective procedures can be challenging, as many hospitals and clinics require proof of coverage. This can lead to longer wait times, limited access to specialists, or even the denial of non-emergency services.

Missing Out on Employer and Tax Benefits

Many employers in the U.S. offer health insurance as part of their benefits package, often covering a significant portion of the premium. If you forgo health insurance, you may be missing out on employer contributions that help lower your overall healthcare costs.

Additionally, health insurance premiums paid through an employer-sponsored plan are often deducted pre-tax, reducing your taxable income. For those who purchase insurance independently, premiums may be deductible under certain circumstances, such as if you are self-employed. Without coverage, you could miss out on these potential tax benefits while also facing higher out-of-pocket healthcare expenses.

How to Protect Yourself Without Health Insurance: Step-By-Step Guide

Navigating life without health insurance can be overwhelming, but with the right approach, you can still access healthcare and reduce financial risks. Follow these steps to safeguard your well-being, mitigate the risks associated with being uninsured, and prepare for unexpected medical expenses:

Step 1: Build an Emergency Fund

Setting aside money for medical emergencies is crucial when you don’t have insurance. Aim to save at least three to six months’ worth of living expenses to cover unexpected healthcare costs.

Consider opening a Health Savings Account (HSA) if you have a high-deductible health plan. HSAs allow you to save pre-tax dollars specifically for qualified medical expenses, helping you manage healthcare costs more effectively.

Step 2: Explore Affordable Coverage Alternatives

Even without traditional insurance, there are other affordable options:

- Catastrophic health insurance: It offers minimal coverage for routine care but protects against major medical emergencies.

- Health-sharing plans: These involve pooling resources with others to share medical costs.

- Short-term insurance: Provides temporary coverage for medical emergencies.

- Discount medical plans: These offer reduced rates on healthcare services.

- Medicaid or Medicare plans: Check if you qualify based on income, age, or disability.

- Subsidized marketplace plans: Government programs offer low-cost insurance based on income level.

Research and understand the eligibility criteria for these plans, then determine your eligibility and apply for the available plan that fits your needs.

Step 3: Use Free or Low-Cost Healthcare Services

There maybe free and affordable healthcare options that you can utilize, including:

- Community clinics and health centers: They provide services on a sliding-scale fee based on income.

- Telemedicine services: Virtual healthcare visits are often more affordable than in-person consultations.

- Prescription assistance programs: Some pharmaceutical companies offer financial aid for prescription medications.

Step 4: Prioritize a Healthier Lifestyle and Preventive Care

Taking proactive steps to stay healthy can help you avoid costly medical treatments. Focus on:

- Maintaining good hygiene to prevent infections.

- Eating a balanced diet and staying hydrated.

- Exercising regularly to strengthen your immune system.

- Getting enough sleep for overall well-being.

- Avoiding risky behaviors that could lead to injury or illness

Making an informed decision

Health insurance may seem unnecessary for some, but the risks of going without it are significant. While alternatives like savings funds, clinics, and telemedicine represent viable stopgap measures, they don’t match the protection traditional insurance provides against catastrophic medical expenses. For most, some form of coverage remains the safest and smartest choice.

Unfortunately, the costs of health insurance are beyond what many people can afford. In reality, you will likely have to forego other expenses or save money to be able to afford a health insurance plan. The best case scenario for most people is to join an employer insurance plan or to use programs such as Medicare or Medicaid if eligible.

While skipping health insurance is a gamble, it could actually lead to significant savings. Just remember to do thorough research and weigh all of the pros and cons before making a decision.