I was still in college when I started investing 1,000 dollars a month. That I firmly believe that this is something anyone can do! The key is to make sure you are managing your money properly.

Of course, to invest $1,000 a month, you must first learn how to save $1,000 a month. The two main things you will need to learn to start investing 1,000 dollars a month is realistic budgeting and automation. This is particularly true if you don’t have a large income!

The income you will use for investing is called “disposable income”. This is the money that is left over after you pay for the basic things you need to survive. This post will share how I invested my first 1,0000 dollars in a month while I was still in college and how you can find the money in your budget to get started too!

Table of Contents

- How I started investing while still in college

- How I saved 1,000 dollars a month while still in college

- How to invest $1,000 and double it (Case Study)

- How to find the money to start investing 1,000 dollars a month

- Start Investing 1,000 dollars a Month: Example Budgets

- Net Worth Targets By Age

- Investing 1,000 Dollars a Month via Automation

- Allow for Flexibility

How I started investing while still in college

When I first started investing during my junior year, I would try to transfer whatever extra money I had to my brokerage account. If I had a night out and was spending $30 with friends, I figured I had no excuse to not send at least $10 to my brokerage account!

Each week, I would transfer anywhere from $20-$100 to my brokerage account. Instead of investing it right away, I would keep adding to it slowly over time so that I wouldn’t pay as many investing fees.

At the end of the month, I would do an extra deposit of whatever money I hadn’t spent. This was usually a small amount as well, often only totaling about $70-$100. Once I accumulated around $1,000, I would make a lump sum investment and purchase some stocks.

With this method, I was able to save around $500 or so a month and would invest the money every other month. I did this because I could still take the money out of my brokerage account if I had miscalculated my spending or expenses each month. In a way, I was using my brokerage account as a mini-emergency fund throughout college!

How I saved 1,000 dollars a month while still in college

When I first saved 1,000 dollars in a month, it wasn’t even a goal I was trying to accomplish! As someone who had a lot of anxiety around investing for the first time, I was much more focused on how much I was able to save and creating the habit. I believe the habit of saving, no matter how little, is something that can be learned over time.

Even though I was saving such a small amount each week, by the end of the year I could see that I already had a sizable amount invested. This really motivated me to double down on my savings by increasing my income!

It was actually during my senior year that I was finally able to invest my first 1000 dollars in a month. During this time, I was only $15 an hour, plus commissions, at my college job. However, I was also picking up whatever side hustles I could find.

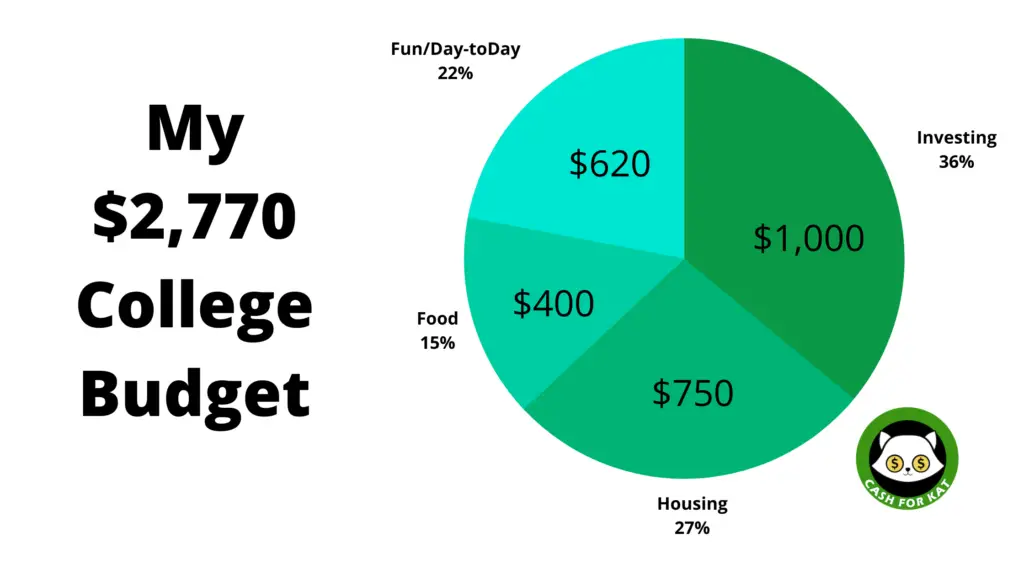

During the summer, I was finally able to work around 30 hours a week. This gave me a monthly take-home of $1,800, which isn’t a lot in California. Especially when my rent was $750! That is why earning commissions at my job was part of the extra disposable income I needed to start investing 1,000 dollars a month.

The power of variable income

Since most of the students went home during the summers, there was always a shortage of callers. This resulted in a lot of bonuses and incentives to get us to work as much as possible. As you know, I was on a mission to get every extra penny I could! I would work every shift possible, which had the added benefit of reducing the free time to spend my money.

Eventually, I became friends with many of the other callers. This made work feel more like I was getting paid to hang out with my buddies! In addition to this, they would also feed us during most shifts. This dramatically lowered my social spending and reduced my fixed spending on food significantly.

Long story short, I was able to work enough and qualify for every incentive possible… and earned a $750 commission check on top of my $1,800 base pay. The rent on my crappy apartment was $750 a month in the San Francisco/Bay Area and I was only spending around $400 on food/fun since most of my life revolved around work.

The power of side hustles

In addition to keeping my expenses extremely low, I was still picking up money by side hustling. I made an extra $20 by pet sitting my friend’s rat for a few days and an extra $200 handing out fliers at a two-day, on-campus event as a student representative for a local credit union.

I was having plenty of fun doing extremely cheap activities and making money at every opportunity possible. I didn’t even realize I was investing 1,000 dollars a month…until the following month!

How to invest $1,000 and double it (Case Study)

Research shows that if you invest in the stock market, you can expect an average annual return of 7%. Using the Rule of 72, shows that it will take about 10 years for your initial investment to double at this rate! Of course, numbers always sound good in theory. But does this data hold up to reality?

The good news for both of us is that I’ve done an accidental case study on this! Back in 2017, when I first invested the $1,000, I put it all in a Roth IRA. I then proceeded to do absolutely nothing with it for the last 4 years (2016-2020). My money sat there, with no sales or purchases, fully invested in the Vangaurd Total Stock Market ETF (Ticker: VTI).

This ETF is meant to track the overall performance of the total stock market. And for the last 4 years, that is exactly what it did! My initial investment of exactly $1,000 is now worth $1,720 today! Not only are we on track to double the initial investment in 10 years, but we are on pace to far surpass it.

Do you think you can see these kinds of results?

I hope you answered “yes”! Please note, I was able to do this back in college when I had little to no investing experience. All it took was some research, saving, and a brokerage account!

Part of why I love investing in index funds is that they do not try to do anything fancy. The ones that I like to invest in are just shares of the top US or International companies and so the returns I get is a reflection of how they are doing.

Four years later and I still stick to this simple index fund investing strategy. One day I will likely have fun picking a few individual stocks to invest in, but for now I love the confidence I have knowing my money is invested in the way that Warren Buffett recommends. If it’s good enough for a billionaire, it’s good enough for me!

Update (2022): After college, I started a few 401k accounts through the companies I was working at. Most of these had set investing options, which has greatly increased the diversity of my portfolio by adding mutual funds, REITs, and more! That being said, the bulk of my investments are the same/similar to what I was doing when I first started investing!

How to find the money to start investing 1,000 dollars a month

Personally, I think that savings should be one of everyone’s top priorities. When I invested my first 1,000 dollars in a month, my budget placed a high priority on setting aside money. You can invest in many different ways, whether you prefer first saving 1000 dollars to invest as a lump sum or investing a little at a time.

To get started, calculate out your basic necessities, high-interest debt, investment goals, then all other expenses. Basic necessities include food, housing, and utilities. High-interest debt is anything above a 5% interest rate but usually does not include things with lower rates such as student loans.

You can decide your investment goals based on what money is left over after your basic necessities and high-interest debts are accounted for. Any money that is left after you’ve paid for your basic necessities is your disposable income and therefore is money that could be invested!

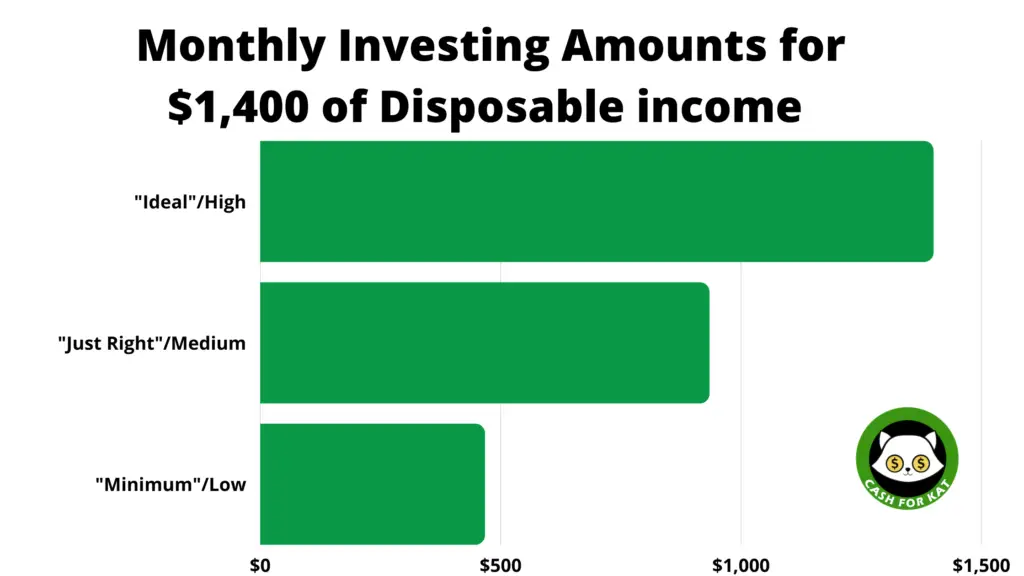

I recommend taking a look at how much is leftover in your budget and creating high-medium-low calculations for your investment potential each month.

Start Investing 1,000 dollars a Month: Example Budgets

Do you know the story of Goldilocks? She went into the bear’s den to try out their porridge and found that one was too hot, too cold, and just right. Then she decided to take a nap on their beds and found out that one was too hard, too soft, and just right.

I use the same principle when it comes to understanding how much money I should be investing each month. Saving all of my disposable income is “too hard”. Saving a little of my disposable income is “too easy”. But how do we find out what is “just right”?

Let’s answer that question by calculating what we could consider to be our high, medium, and low investing goals.

“The Ideal”- High Investment Rate

For an easy example, let’s say that you make $3,000 a month after tax ($36k annual). Once you account for $750 a month in rent, $600 for food and necessities, and $250 in student loans you have already used 1,600 of your budget!

That means you have around $1,400 leftover every month that can be used for your material wants, fun activities, and investing. If you decide to invest all of that money, you are utilizing 100% of your disposable income. By staying on this kind of tight budget, you will be able to invest $16,800 a year!

This is a fantastic accomplishment but is not realistic because you will not be able to spend any money on fun activities. If you deprive yourself of enjoying the money, just like with dieting, you are likely to binge and spend a large lump sum out of the blue. Plus, this causes you to associate negative feelings, such as deprivation, with investing.

“Just Right”- Medium Investment Rate

Above we discussed what happens if you are investing 100% of your income. I call this the “ideal” or “high” investment rate because it is obtainable, but not necessarily sustainable long term. It is important to understand what is possible for you to accomplish so that the lower goals seem more obtainable.

To set more realistic goals, I like to divide my disposable income into thirds. From our example above of a disposable income of $1,400, each third would be valued at $466 apiece.

We’ve already discussed how unrealistic it is to invest 100% of your disposable income, but what if you choose to save two-thirds? That would result in $933 a month that you are able to invest! The rest of that money you could use for fun activities or other desires that improve your lifestyle.

Investing two-thirds of your disposable income is much more sustainable than investing all of your extra cash!

“The Minimum”- Low Investment Rate

Let’s be real. There is no such thing as a low investment rate! As long as you are investing some of your money, you are already accomplishing much more than the average American.

From the example above, your minimum investment rate should be around $466. This is one-third of your disposable income, which means you are still able to use over 66% of your money to satisfy your wants! At this “low” investment rate, you will still be able to invest over $5,500 annually.

A lot of people ask themselves, “how much money should I be investing each month”. Instead of arbitrarily throwing out a number, I like to use this method because it shows you what you could be saving based on any income level and allows you to choose a level of savings that makes the most sense for you.

Another way to figure out how to make investing work for you is by identifying what type of investor you are. You can think of things like your investment horizon (aka how long you have to make a return on your investment), your asset allocation, and risk tolerance. All of these might play into how you define your investing goals!

To increase savings, cut as much as you can from your monthly spending!

If you do not have anything available after accounting for basic necessities and high-interest debts, then you likely have a lot of recurrent expenses in your budget that needs to be canceled or reduced.

To check for these things, I have a free subscription reduction worksheet. If that is not the case, then you likely have an income issue and need to start side hustling or increase your rate at your full-time position.

Net Worth Targets By Age

Finding the right investment amount for your current income is a great first step towards managing your finances. Once you’ve been able to make the most of your current budget, then it is time to start looking for benchmarks for your future.

One great way to make sure you are on target for a good financial future is by looking at The Best Interest’s post on Net Worth Targets by Age. The charts are particularly interesting because it breaks down net worth targets by percentile!

The younger you are, the more risk tolerance you might have. This means you might even consider more unique investments, such as investing in comics or even your favorite gaming cards. The only thing to consider is making sure they are safe from wear and tear… and be sure not to lose them or sell them to early!

Investing 1,000 Dollars a Month via Automation

Now that you are able to set investing goals that are realistic and based on your disposable income, it is time to start automating your finances.

The best way to make sure you don’t spend your money is by investing it first! The longer money is sitting in your bank account, the higher the chances that you end up spending it before it ever makes it to a brokerage account!

I originally learned this daily investing trick from Grant Sabatier at Millennial Money in his article, Early Retirement Strategy: Retire Early with $50 a Day. Grant wrote about how he used to invest every single morning when he had his coffee, even if it was only $5 a day. This is great because even $5 a day results in $1,825 in investments a year!

I set up my brokerage account with Vanguard to transfer money from my checking account 2-3 days after payday. The 2-3 day lag gave my paycheck just enough time to be fully deposited in my account but made sure the money was gone before I had a chance to spend it. That money isn’t mine, it is Future Kat’s!

Why does automation work so well?

I would essentially treat investing like a bill that had to be paid every month. That way, putting money aside isn’t something that is optional or that is left to chance. You’ve already planned what you can afford to put aside and the rest of your spending habits will have to conform!

In addition to this, I would check my budget every morning to see if I had a few extra dollars I would feel comfortable investing too. Anything in addition to my initial savings would make me feel really proud and I’d get a small daily dose of accomplishment. As silly as it sounds, these are small ways to start thinking about saving and investing as a fun activity that you get to do.

More importantly, by making investing a habit, you might be able to save even more than your medium or low savings goals because you are investing what you can at the moment. These incremental savings become very powerful over the course of a few years!

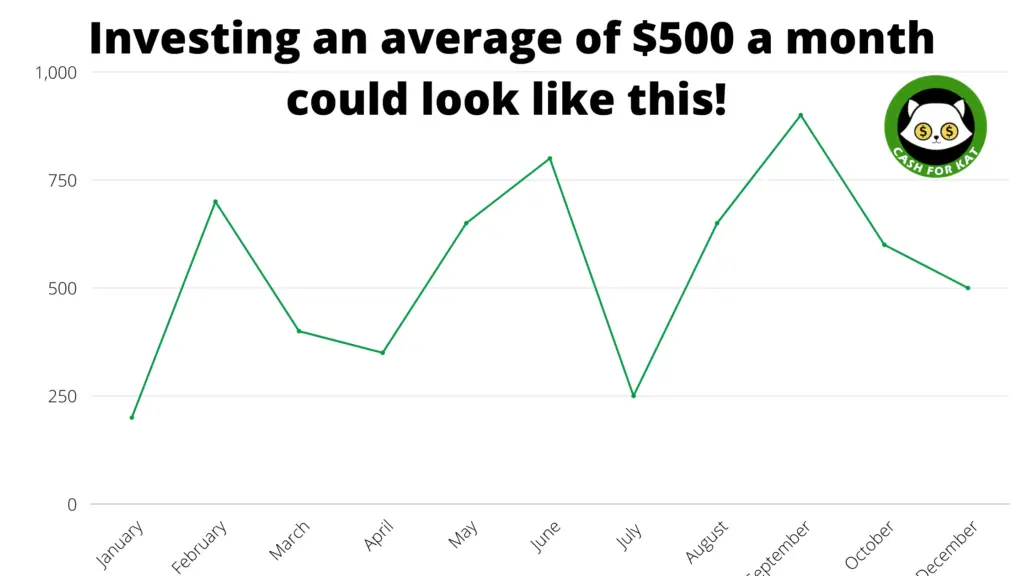

Allow for Flexibility

Some months you may want to be a little anti-social, which in turn allows you to have a high saving rate. Other months, you will have a bunch of surprise expenses that decrease your ability to save.

Here is what I wish I knew when I started investing: You do not have to maintain a consistent savings rate!

It turns out, that successful investing is more about what you can do on average. And since you are in it for the long haul, it is best to look at these averages over the course of a year.

Maybe, no matter how much budgeting you do, you are only able to save on the lower end of the scale each month. That’s ok because little tweaks to your earnings can easily bump your average up by the end of the year. Maybe you will save all of your tax returns or other spontaneous windfalls. Perhaps, you will use this as motivation to ask for a raise at work or start a side hustle.

Many roads lead to Rome and it can take many different investment amounts to hit that $1k a month goal! If you don’t have enough disposable income to start investing 1,000 a month, I highly recommend checking out this post’s companion, Saving 1,000 a Month: 10 Actionable steps.

Kathryn Rucker is a sales consultant and content writer. With 7+ years of sales experience, she is passionate about helping businesses and individuals grow their sales pipelines by improving their online presence.

She has been traveling full-time since 2018 thanks to the location and financial independence she has gained from her business, Kat Rucker Consulting Group. You can connect with her on LinkedIn.

Disclosures and Disclaimers: The above references an opinion and is for entertainment purposes only. It is not intended to be investment or insurance advice. Seek a duly licensed professional for your financial planning. Bear in mind that some of the links in this post are ads/affiliate links and if you go through them to make a purchase I will earn a commission (thanks!). Keep in mind that I link these companies and their products because of their quality and not because of the commission I receive from your purchases. The decision is yours, and whether or not you decide to buy something is completely up to you.

I liked your determination to save money and invest.

“even $5 a day results in $1,825 in investments a year!” 😳 I think I need to start looking at my $5 bills more critically. 😅

Your college budget looks a lot like my adult budget in some months. Sure we splurge here and there, but the core isn’t too far off! I think this is a really good starting point, particularly if you can set these habits up in college. Not to mention, the extra time you would have in the stock market.

I wish I invested $1,000/month in college!