Warren Buffett ETF Strategy 101

“What is the Warren Buffett ETF strategy?” – Me, asking all the hard-hitting personal finance questions.

After watching the annual Berkshire Hathaway shareholder meeting I was interested in learning more about Warren Buffett. Which of his investing quotes is best? What are his Coronavirus quarantine thoughts? Does he include french fries in his McDonald’s menu order?

You name it, I want to know it. And if you are still reading this, I bet you are obsessed with this 89-year-old investing genius too. Who wouldn’t want to dissect the lifestyle habits of a self-made billionaire who is occasionally able to beat the stock market?

Who is Warren Buffett?

Warren Buffett is one of the most famous and successful investors in the world. He is the CEO of Berkshire Hathaway and has a net worth of over $70.5 Billion!

In fact, that’s his net worth as of April 2020, during the Coronavirus’ peak. Prior to the ‘Rona, his net worth was a whopping $88.9 Billion in December of 2019.

Buffett became a billionaire in 1990 and is about as “self-made” as you can get. Even as a child he started his own businesses delivering newspapers, selling golf balls and stamps, and placing his pinball machines in local stores. All before his 18th birthday!

Known as “The Oracle of Omaha”, Buffett lives a simple life in Nebraska maintaining the modest spending habits that helped him acquire his fortune in the first place. He enjoys the value menu from McDonald’s and lives in the same house he bought in 1958 for $31,500.

If there is one person to learn from when it comes to business and investing, it is Mr. Buffett. He is the master of understanding the intrinsic value of stocks. Check out this great photo of the Oracle of Omaha staring into your financial future.

What is an ETF?

Though Buffett has many tips for successfully investing in the stock market, I find his suggestions around ETFs to be the most useful for the average investor. But before we can emulate Buffett’s ETF strategy, let’s get back to the basics.

ETF stands for “Exchange-Traded Fund”. “Exchange-Traded” means that they are bought and sold on stock exchanges, such as the New York Stock Exchange and Nasdaq. If you have investment or retirement accounts, you might buy and sell via a company such as Vanguard, Fidelity, TD Ameritrade, etc.

“Fund” means that it is a grouping of investments like stocks or bonds. You may have tens, hundreds, or even thousands of different stocks or bonds in one index fund! That is why ETFs are great for diversification. However, it is important to note that the size of the ETF doesn’t matter too much unless there is some sort liquidation event.

An ETF is a simple way of investing because you do not choose individual stocks. Instead, you are purchasing a set investment portfolio that follows a specific segment of the financial market. ETFs are more diversified because you are buying into a variety of investments instead of just a single stock.

If you are looking to understand more about how ETFs work, I highly recommend Financial IQ by Susie Q’s post on Mutual Funds and Exchange-Traded Funds. She breaks down everything you need to know before you buy and deep dives into how these funds work in a diversified portfolio.

ETF Example: Vanguard Total Stock Market ETF (aka VTI)

An example of this would be one of my favorite ETFs, the Vanguard Total Stock Market ETF (VTI). VTI is comprised of a variety of stocks that follows the growth of some of the largest companies in the US in a variety of industries (Tech, Health Care, Industrials, etc).

If you were to buy an individual share of Apple, Amazon, Facebook, etc., you would need to invest over $200 each! You could wait and save the money to make individual stock purchases of these companies… Or you can buy into an ETF like VTI for only $147 and own a fraction for each of these companies and more!

Does Warren Buffett own ETFs?

Ah, the multi-billion-dollar question. The answer is that Warren Buffett’s career is all about picking his own stocks. Buffett is focused on finding undervalued stocks and selling them for a profit. It’s what he is known for. It’s his thing.

But as of February 2020, Warren Buffett’s company, Berkshire Hathaway, has bought ETFs. And more than likely this is thanks to the Coronavirus’s impact on the stock market. The Warren Buffett ETF strategy is the result of his investment philosophy of only buying into companies you believe will have long term value.

Why Does Warren Buffett like ETF’s?

There are a variety of reasons to love ETFs. They are a very simple but diverse investment strategy. They often have lower fees and are a passive form of investing. Passive investing is great for the hands-off investor that may not be as interested in monitoring their portfolios.

For the average investor, Buffett recommends ETF’s. It is also a good idea to utilize dollar cost averaging to slowly build up your ETF Portfolio!

Buffett also practices what he preaches when it comes to his own estate planning. When he passes, his widow will inherit some of his fortunes, and Buffett has directed for it to be placed into a variety of ETF’s.

In fact, Buffett once made a bet with the hedge fund industry back in 2008 to the tune of one million dollars. The bet was that an S&P 500 index fund would outperform a hand-picked portfolio over a 10 year time period. Spoiler: Buffett was correct.

If that isn’t enough evidence in favor of investing passively v.s. active, then you might want to listen to this story from Fidelity. They wanted to find the secret behind which accounts were performing best. It turns out most of the accounts were owned by someone who forgot they had a Fidelity account!

Warren Buffett’s ETF Selection

When it comes to investing, active investing tends to be more prone to human error. No matter how long you’ve been investing, humans tend to make big decisions at bad times. Whether that is due to an emotional state, fluctuations in the market, or acting on educated guesses, people tend to underperform the market.

That is why the Warren Buffett ETF strategy is meant to track the market! The classic “if you can’t beat them, join them” philosophy. Instead of trying to outperform the market, you can choose to invest in ETFs that mirror the market!

Thus, you have gains and losses that are similar to the stock market’s fluctuations. This means that you will hopefully also have an average annual increase of 7% (adjusted for inflation) that the market has seen since inception.

Now it’s the moment we’ve all been waiting for. Here are the only publicly disclosed ETF’s of Warren Buffett’s company, Berkshire Hathaway!

The first is the Vanguard S&P 500 ETF (VOO)

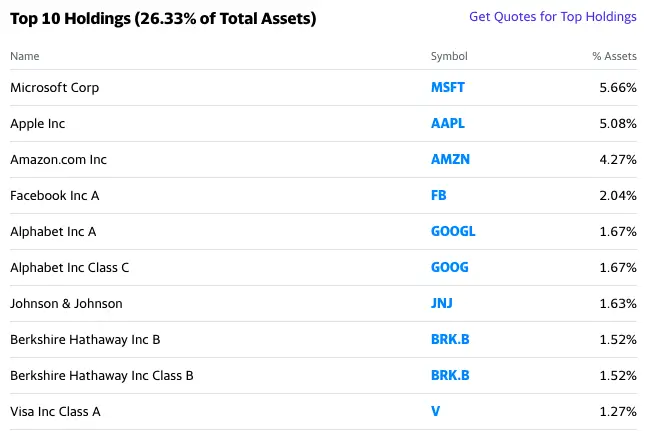

The VOO ETF tracks the S&P 500 and when you buy into it you are purchasing a portion of the top 500 public companies in the US. This ETF is provided via Vanguard and has a very low expense ratio of .03%.

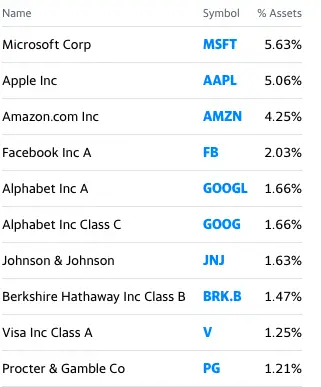

You will notice that its holdings are very similar to the other Warren Buffett ETF pick. In fact, the top 10 companies are almost identical! The only main difference in the top 10 is the percentages of the holdings.

The second is the SPDR S&P 500 ETF (SPY)

Similar to VOO, the SPY tracks the S&P 500 and gives an investor exposure to the top 500 public companies in the US. The main difference is that SPY has an expense ratio of .095%. This is still very low, but over a long period of time, it would chip into your earnings when compared to similar funds.

Final Thoughts on Warren Buffett’s ETF Strategy

I hope this post helped you to understand why the Oracle of Omaha invests the way he does! If you liked this post and are interested in learning more about index investing, be sure to check out this post by Mr.FightToFIRE on 7 important lessons from index investing.

If you enjoyed this article, don’t forget to subscribe! I will be posting a follow-up article about Warren Buffett later this week.

Kathryn Rucker is a sales consultant and content writer. With 7+ years of sales experience, she is passionate about helping businesses and individuals grow their sales pipelines by improving their online presence.

She has been traveling full-time since 2018 thanks to the location and financial independence she has gained from her business, Kat Rucker Consulting Group. You can connect with her on LinkedIn.

Kathryn Rucker is a sales consultant and content writer. With 7+ years of sales experience, she is passionate about helping businesses and individuals grow their sales pipelines by improving their online presence.

She has been traveling full-time since 2018 thanks to the location and financial independence she has gained from her business, Kat Rucker Consulting Group. You can connect with her on LinkedIn.

Hey Kat, amazing post! Thanks for your very succinct and informative summary. I am sure many people will get a lot of value out of it.

Thank you so much! I’m glad you enjoyed it 🙂

Great explanation, I will include this in my weekly email roundup.

Thanks, Kat! I’m excited to see it and glad we were able to collaborate this month! If anyone is interested, Kat guest posted on CashforKat this week and shared her journey to making a full-time income as a freelancer.