Saving money doesn’t have to feel overwhelming or dull. The 100 Envelope Savings Challenge is shaking things up by providing not just a structured way to save, but also a fun and flexible one. Designed for financial newbies, this challenge can help you build better money habits, achieve short-term savings goals, and set the stage for a more secure financial future.

In this guide, you’ll learn the ins and outs of the 100 Envelope Savings Challenge, tips to tailor it to your goals, strategies to stay motivated, and inspiring stories from those who’ve completed it. By the time you’re done reading, you’ll have the knowledge and inspiration you need to start your savings journey today!

Table of Contents

- What Is the 100 Envelope Challenge and How Does it Work?

- The Digital Version of The 100 Envelope Savings Challenge

- Is the 100 Envelope Challenge Realistic?

- Adjusting the 100 Envelope Saving Challenge to Fit Your Lifestyle

- Tips for Staying Motivated During the 100 Envelope Savings Challenge

- Start Your Road to Financial Freedom Today

What Is the 100 Envelope Challenge and How Does it Work?

The 100 Envelope Challenge, also known as the 100-Day Money Challenge, is a fun and structured savings method that has gained popularity on TikTok and other social media platforms. The goal is to build up $5,050 in just over three months by consistently setting aside money each day.

Each day, you select an envelope and place inside it the amount of cash that matches the number written on the front.

For example:

- On Day 1, you put $1 into envelope #1.

- On Day 2, you place $2 into envelope #2.

- On Day 3, you deposit $3 into envelope #3.

This pattern continues, increasing the amount by $1 daily until you reach the 100th envelope, where you add $100. By the end of 100 days, you’ll have saved a total of $5,050.

For a more unpredictable approach, you can shuffle the envelopes and draw one at random each day. This means you could pull envelope #35 on the first day and deposit $35, then pick envelope #4 the next day and add $4. You then continue this process for 100 days or until all of the envelopes are filled with cash. This approach spreads out the larger amounts, making the challenge more flexible while still leading to the same total savings of $5,050.

Regardless of how you choose to do it, the 100 Envelope Challenge is a fun and structured way to build a savings habit while watching your cash grow over time.

The Digital Version of The 100 Envelope Savings Challenge

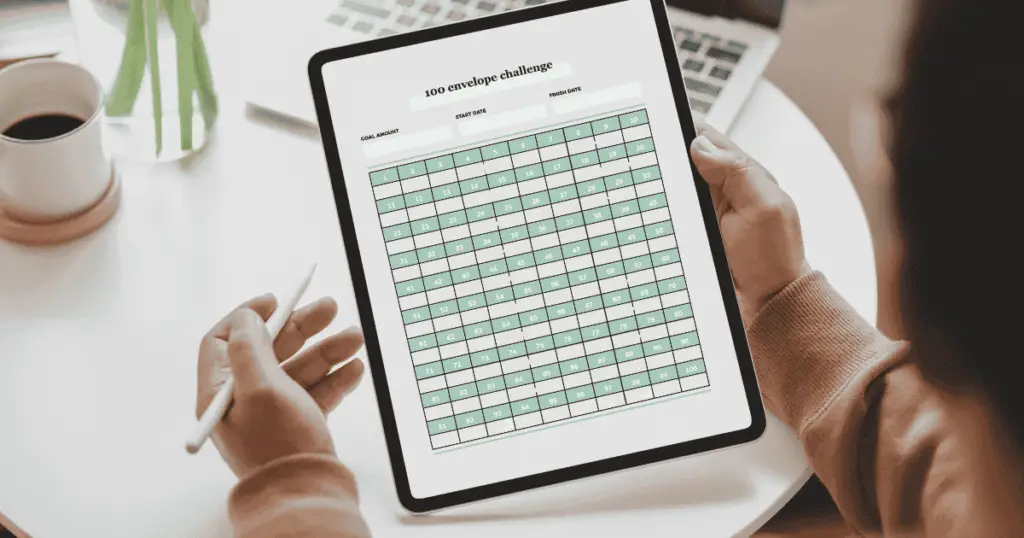

Let’s face it, most of us don’t carry around wands of cash, which could turn this challenge into a chore. The good news is that you can easily complete the challenge digitally. Instead of using physical envelopes, download a free “100 Envelope Challenge” tracker (widely available online) or create a simple spreadsheet.

You can do the challenge in order from 1 to 100 or use an online random number generator to pick a random number each day. Once you have your number, deposit the corresponding amount into a dedicated savings or checking account. To maximize your savings, consider using a high-yield savings account, which allows you to earn interest on your deposits.

Is the 100 Envelope Challenge Realistic?

The 100 Envelope Challenge can be a tough commitment, especially with the rising cost of living, low wages, and everyday expenses. You’ve got to be intentional with your savings and practice lots of self-control during those 100 days. For instance, saving a large amount of cash in a short time isn’t always practical.

While the 100 Envelope Challenge isn’t realistic for everyone, it is doable with careful planning, discipline, a little creativity, and the right strategy and motivation. Alternatively, you could start with a shorter challenge, like 50 days to make it more achievable.

Here are some practical and motivational tips to help you successfully complete the challenge:

Create a Budget

The best way to ensure you have enough cash for this challenge is to tell your money where to go each month. Start by creating a budget to track your income and expenses. A free budgeting app, like Lunch Money, can make this process easier and keep you on track.

Increase Your Income

If saving extra cash feels overwhelming, look for ways to boost your earnings. You can do this by:

- Picking up a side hustle (deliver food, pet sit, freelance, or tutor).

- Selling unused items around your home.

- Working overtime, if possible.

It might require extra effort, but it’s only for 100 days! You’ve got this.

Cut Unnecessary Spending

One of the easiest ways to free up cash for the 100 envelope saving challenge is to trim non-essential expenses for the duration of the challenge. Ask yourself:

- Can I cut back on impulse purchases?

- Can I skip dining out and cook at home instead?

- Can I pause subscriptions I don’t absolutely need?

- Do I really need that daily coffee shop latte?

Even small changes add up, and who knows—you might realize you can live without certain expenses because you prefer to have that extra cash in your 100 envelope savings every single month.

Use a 100 Envelope Challenge Chart

Part of what made the 100 Envelop Challenge go viral was that the envelopes were tangible. Visual motivation is a powerful tool that you should not underestimate! If you do decide to go digital, print out a 100 Envelope Challenge chart and mark off each number as you go. Hang it somewhere visible as a daily reminder.

Build Accountability (or Make It a Competition!)

Challenges, such as the 100 saving challenges, are easier and more fun when you have someone to keep you accountable. You can get your spouse, family, or friends to join in.

There is also the option to turn the challenge into a competition with friends and family members to see who can save the longest. Try to keep the savings going after you reach 100 envelopes by continuously adding more days.

Adjusting the 100 Envelope Saving Challenge to Fit Your Lifestyle

The reality is that most people have tight budgets and only have enough to cover essential monthly expenses. Not everyone has extra cash lying around to fill an envelope every day. This is one of the biggest challenges of this method.

Therefore, if saving $5,050 in 100 days isn’t feasible, try to make it more manageable by

- Extending the challenge to 100 weeks instead of 100 days.

- Choosing specific dollar amounts that are realistic for you.

- Customizing the 100-envelope challenge to fill an envelope bi-weekly to match your pay schedule.

- Contributing only when you have extra cash or spare change.

Getting into the higher numbers of the challenge can feel tough and discourage you from reaching your financial goals. Just remember, it doesn’t matter how long it takes you to get the challenge done just as long as you cross that finish line and reach your end goal of saving $5,000! The key is to make saving money fun, consistent, and stress-free! This will help you reach your $5,050 savings goal!

If this method doesn’t work for your current budget, there are plenty of other savings strategies to explore. Here are five alternative savings challenges to try, especially if you want to start small before committing to the 100-day challenge:

30-day savings challenge

This challenge works like the 100 Envelope Challenge but over a shorter period of 30 days. If you choose this strategy, you will be required to:

- Gather 30 envelopes and number them from 1 to 30.

- Each day, pick an envelope and save the amount written on it. You can go in order or shuffle them for a surprise each day.

- By the end of 30 days, you’ll have saved $465.

As with the 100 envelope challenge, you can go cashless and complete this challenge digitally by depositing money into a savings account instead of using envelopes.

365-Day Penny Challenge

Want to start small? The 365-Day Penny Challenge is an excellent way to build savings gradually. For this challenge, you will require a huge jar and a whole lot of pennies.

- On Day 1, save one penny.

- On Day 2, save two pennies, and so on.

- By Day 365, you’ll be adding $3.65 to your savings.

After one year, you’ll have $667.95! If pennies feel too small, you can adjust the challenge to nickels, dimes, or even dollars for bigger savings.

The $5 Bill Challenge

This simple challenge is effortless and fun!

- Every time you receive a $5 bill, put it aside in a savings jar or envelope.

- Keep collecting them without spending until you reach your goal.

Since $5 bills appear more often than you think, this challenge can potentially add up to hundreds or even thousands in a year!

The No-Spend Challenge

If you struggle with impulse spending, try a No-Spend Challenge to boost your savings:

- Pick a timeframe (a week, two weeks, or a full month).

- Only spend money on essential expenses (rent, bills, groceries, etc.).

- Avoid all non-essential purchases, like dining out, shopping, or entertainment.

Use the money you would have spent and put it directly into savings. You might be surprised how much you cut back just by being intentional!

The 52-Week Savings Challenge

This challenge spreads out savings over the course of a year:

- In Week 1, save $1.

- In Week 2, save $2 and so on.

- By Week 52, you’ll be adding $52 to your savings.

At the end of the year, you’ll have $1,378 saved! If you want to save more, you can double the weekly amounts for a total of $2,756.

Tips for Staying Motivated During the 100 Envelope Savings Challenge

Just like many social media trends, the excitement of starting the 100 Envelope Challenge can fade quickly. While the idea of saving a significant amount of money is appealing, actually following through takes discipline and motivation. If you’re struggling to stay on track, here are some powerful tips to keep you motivated and going:

1. Set a Clear Goal

Knowing exactly what you’re saving for makes the process feel more meaningful. Whether it’s a vacation, emergency fund, or big purchase, create a vision board or write down your goal as a daily reminder. Seeing why you’re saving can boost motivation!

2. Track Your Progress

Watching your savings grow can be incredibly motivating. Use a printable chart, a money-saving app on your phone, or a simple spreadsheet to check off each completed envelope. Seeing those numbers increase will keep you excited to continue!

3. Celebrate Small Wins

Break the challenge into milestones and reward yourself when you reach them. Every small step gets you closer to the $5,050 goal so treat yourself to something budget-friendly when you hit key points.

4. Make It Fun

Turn the challenge into a game by shuffling the envelopes and picking them randomly. Getting family or friends involved for extra accountability can make all the difference.

5. Automate or Schedule It

Make saving effortless by setting up automatic transfers to your savings account or scheduling daily or weekly reminders. This helps remove the temptation to skip days!

6. Stay Flexible

Life happens, and so you should realize that there will be low moments and unexpected expenses will arise, throwing you off track. Therefore, if you hit a rough patch, you should stay flexible by:

- Adjusting your savings plan if life gets in the way

- Pausing if necessary, then restart when you’re ready.

It is also vital to remember that you’re building healthier financial habits. Remember, a budget-oriented mindset doesn’t happen overnight and progress matters more than perfection!

7. Keep Your Eyes on the Prize

Stay focused on why you started the 100 Envelope Saving Challenge in the first place. Whether it’s debt freedom, a dream trip, or financial security, visualize the end result whenever you feel discouraged.

Start Your Road to Financial Freedom Today

The 100 Envelope Savings Challenge isn’t just a savings hack, it’s the first step toward building a secure financial future. By following the tips and strategies outlined here, you can make this challenge your own, tailor it to your life, and reap the rewards of both short and long-term goals.

What are you waiting for? Start your challenge today. If you’re looking for more personalized tips, sign up for our free email series and take the first step toward financial freedom!