A few years ago, companies got really good at convincing us to sign up for monthly subscriptions. These days, you can get almost anything delivered regularly, clothing, groceries, even product samples.

Credit card subscriptions make it easy to access different services, but they can quickly pile up. Just Spotify and Netflix alone cost over $20 a month—that’s $240 a year!

Banks often earn commissions from these subscriptions, and you might get some rewards too. But do you actually need them all? Services like Evolve Bank BAAS are shifting how banking works, so you only pay for what you really use.

In this post, I’ll break down how to cancel recurring charges on your credit card and share tips to keep them from getting out of control.

Table of Contents

- The 5 Ways You Can Cancel Your Credit Card Subscriptions:

- How to Cancel All Your Credit Card Subscriptions Using a Worksheet (Free!)

- Best Tools to Cancel Credit Card Subscriptions

- FAQ about canceling credit card subscriptions

- Final thoughts on canceling credit card subscriptions

The 5 Ways You Can Cancel Your Credit Card Subscriptions:

There are a few different ways to cancel credit card subscriptions—and once you understand your options, the process gets a whole lot easier.

Here are 5 ways you can cancel subscriptions from your credit card:

- Online

- By Phone

- Call Your Bank

- Use Subscription Tracking Tools

- Cancel or Change Your Credit Card

1. Cancel Online

Start by logging into the account for the subscription you want to cancel. Head to the billing or payment section (usually under “account” or “settings”), and look for a cancellation option.

If you can’t find the subscription or run into issues, try emailing the company or move on to the next method below.

Steps to cancel subscriptions online:

- Search your inbox for emails like “payment receipt” or “subscription confirmation”

- Log into the related account

- Go to settings > subscription or billing

- Cancel the subscription

- Unsubscribe from marketing emails

Important: You’re still responsible for payments until the cancellation is processed. If you skip these steps, you risk being sent to collections—which can damage your credit score. That’s why it’s crucial to follow through carefully.

2. Cancel by Phone

Even after canceling online, I always recommend calling to confirm the cancellation went through. This method is also useful if you’re having trouble online. Sometimes, you can even request a refund—especially if you’re canceling within 24 hours of being charged.

That said, this is my least favorite option. You’ll likely deal with long wait times, automated menus, and upselling attempts.

Steps to cancel by phone:

- Find the customer service number online or on the company’s website

- Check their hours before calling

- When prompted, say “operator” or press “0” repeatedly to reach a human faster

- Ask for cancellation and confirm the details

Pro tip: Always ask for the name of the person helping you and get the callback number in case you’re disconnected. This saves you from explaining your situation all over again.

3. Cancel by Calling Your Bank

If the other methods fail, you can call the bank that issued your credit card. This can work best if you’re trying to block future payments from a subscription you no longer want—but timing is everything.

Important: If you’ve already received the product or service, you still owe the payment. Don’t use this method to avoid legitimate charges.

mpany itself. That being said, your bank can give you more options for cancelation that might be relevant to your card and situation.

Steps to cancel via your bank:

- Follow the same phone steps listed above

- Ask if the charge is still pending and whether it can be stopped

- Confirm when the subscription will be blocked

- Request a refund if the charge wasn’t authorized

4. Manual cancelation by using subscription tracking tools

There are so many budgeting apps and personal finance tools that can sync to your card and detect recurring charges. If you want to have a better idea of your total financial picture, then this would be a great option for keeping tabs on your bills!

Later in this post, I will share some popular tools you can use to track these pesky recurrent subscriptions.

How to cancel by using subscription tracking tools:

- Select the budgeting app that works best for you

- Give access to your bank or import your data

- Review the automatic reports that are generated

- Identify recurrent expenses, separating subscriptions to be removed

- Use any of the methods in this post to remove subscriptions

I like this method because you will truly be able to see what subscriptions are useful vs. sucking your bank account dry. This method can be a bit more time consuming, but you will find that it helps you cancel the most subscriptions in one go.

Additionally, some apps do more than budgeting. There are a few apps that focus on helping you cancel subscriptions on your credit card and can work on your behalf to proactively remove them. Often this is as easy as pressing a button!

4. Use Subscription Tracking Tools

Budgeting apps and subscription trackers can automatically detect recurring charges on your cards. If you’re trying to get a clearer picture of your finances, this is one of the best places to start.

Later in this post, I’ll share some of my favorite tools. But for now, here’s how the process works:

Steps to cancel with tracking tools:

- Choose a budgeting or subscription app that works for you

- Connect your accounts or import your data

- Review the report to spot recurring charges

- Decide which subscriptions to cancel

- Use one of the methods above to cancel directly

I like this approach because you can quickly see which subscriptions are actually useful and which ones are quietly draining your bank account. It takes a little more time up front, but it’s the best method for canceling several subscriptions at once.

Some apps go a step further and cancel subscriptions for you with just a tap. That’s a huge time-saver!

5. Cancel or Change Your Credit Card

If nothing else works, you can call your bank and ask to stop the payment. But this only works if you catch it quickly, usually within 24 hours.

This should be your last resort. Cancelling a card or stopping payments on legitimate charges can hurt your credit score or even lead to collections. Only use this option if the charge was unauthorized.

Steps to cancel subscriptions through your bank:

- Call and ask for more info about the charge

- Confirm whether the payment can be suspended

- Ask when charges will stop

- Request a refund if it wasn’t an authorized purchase

This process usually takes less than 20 minutes. It also helps you confirm what the charge is—many companies bill under a different name, which can be confusing.

If the charge wasn’t authorized and was made on a credit card, you might be eligible for a refund. Policies vary by bank, but it’s worth asking!

How to Cancel All Your Credit Card Subscriptions Using a Worksheet (Free!)

If you’re not ready to give apps access to your bank info, I’ve got you covered. I created a free worksheet to help you quickly identify and cancel subscriptions.

It’s perfect if you only have a few subscriptions or just want a low-tech way to track everything. I use this sheet once a year to do a quick audit of my spending—and it always helps me find something to cut!

Even canceling just one subscription can save you $100+ per year. And it only takes a few minutes.

Best Tools to Cancel Credit Card Subscriptions

These days, there are hundreds of different apps, platforms, templates, etc. that can help you keep track of your finances. Most of them have built-in notifications that can help you spot recurrent charges quickly.

A good place to start looking for these tools is through your bank. This will be much more secure than giving a third party your account information. Another benefit is that it helps to ensure the data is as up-to-date as possible. If you are looking for some easy and basic tools, then you may find everything you need at your bank!

The benefit of third-party apps is that they can often help you visualize your spending with graphs. They also have additional tools that can help you calculate and project your spending patterns instead of just monitoring.

No matter what you choose, these tools are sure to help you save money in minutes!

Banks With Subscription Canceling Tools

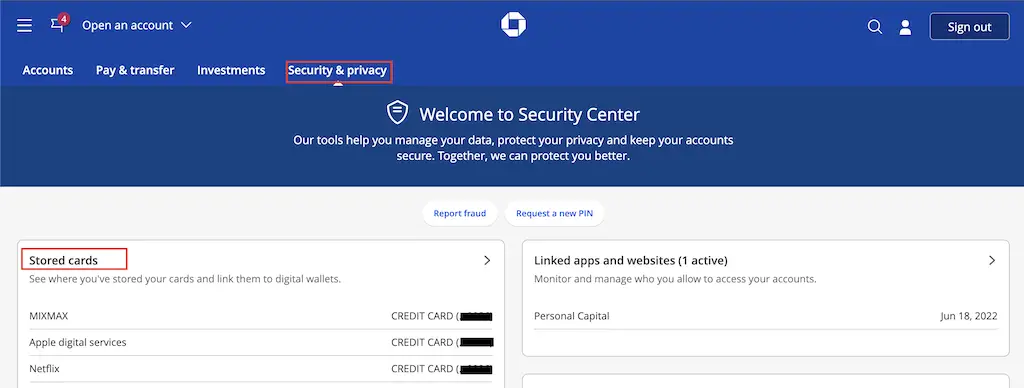

Two well-known companies that offer these account management tools are Chase and Capital One. Read on to learn more about the Chase Account Manager feature and Eno from Capital One!

Chase Saved Account Manager

Using the Chase Saved Account Manager allows you to see where your credit card information is stored. Naturally, most of these places store your information so they can charge you each month!

This provides an easy-to-follow list of companies that you might need to unsubscribe from. This tool also helps you cancel subscriptions you no longer want.

If you already have a Chase account, simply navigate to the “Security Privacy” tab to get started!

Eno from Capital One

If you have a credit card through Capital One, you can use the free tool Eno to track your subscriptions and track your spending. This tool is also great for monitoring your account.

Budgeting tools for canceling subscriptions

No matter what your budgeting style is, there are sure to be many tools that can help you both manage your finances and cut down on subscriptions.

Most tools have a free version that you can use, with options to gain deeper insights if you switch to a paid plan. For the purpose of canceling subscriptions, most free plans should have all the functionality you will need.

AskTrim.com

This is a comprehensive tool you can use to track your subscriptions monthly. Also known as Trim, you can cancel your subscriptions and even set up a cancellation to occur when your contract ends. Trim will take care of the cancellation when the time comes.

This tool can also keep track of how much you spend on a subscription and alert you if the monthly cost has increased. They can even reach out to your credit card company and negotiate a better price on your behalf!

According to their website, most Trim users save an average of $620 a year through this tool!

Hiatus

This tool will send you a notification before a monthly subscription payment comes off your credit card, giving you enough time to cancel if you no longer want that subscription.

You can also take advantage of Hiatus by using it to analyze your finances and help you negotiate deals with companies that could be offering you a better deal. Hiatus also provides personalized financial advice.

RocketMoney (Formerly Truebill)

Rocket Money will help you to create a clean and tidy list of your subscriptions. You can cancel your subscriptions with a click of a button, as well as set up reminders for bill payments.

This popular app has saved members over $100 million in the last 5 years and has over 2 million members!

DoNotPay

DoNotPay likes to deem itself the world’s first robot lawyer and offers users help with appealing parking tickets, cancel subscriptions, and get refunds for late deliveries. They utilize AI to find the subscriptions you need to cancel.

You can also sign up for a free trial to a subscription, and DoNotPay will cancel that subscription before you start to pay for the subscription!

Mint.com

Mint is one of the most popular budgeting platforms around! This is a great tool if you are a bit more hands-on when it comes to budgeting.

They have special features that allow you to manage your subscriptions. Mint can also send you a reminder before the bill comes out of your account and alert you if the monthly bill has increased.

Bobby

If you are not comfortable connecting your credit cards or bank accounts to an app, then Bobby is for you. You do have to put in all your information manually, but you can track monthly expenses and recurring subscription charges, and the billing cycle to help track the payments better.

Note that this is only an app; there is no web version for those of you who prefer to use a computer for your finances. That being said, Bobby does have a very simple and friendly user interface.

Additionally, they are one of the few apps that allow you to keep track of foreign currencies!

Track My Subs

As you can guess by the name, Track My Subs has some of the most comprehensive tools available for tracking your subscriptions. You can see everything in a chart form and get a detailed breakdown of how much you are spending each month.

The free version allows you to track up to 10 subscriptions, and you don’t need to use your credit card to sign up!

FAQ about canceling credit card subscriptions

How do I cancel all credit card subscriptions fast?

So far, we have covered all the ways to remove individual subscriptions. What if you need to remove a lot of subscriptions at the same time?

The obvious way would be to cancel the card, but that is not something you should do spontaneously as it could negatively impact your credit score. Another option would be to ask the bank to send you a new card!

This would change your numbers, and the company would no longer be able to charge you with the information they have on file. Be careful, though! If this is money that you owe for a product or service you’ve already received, then they could send you to collections!

How can I see all my subscriptions on my card?

The best way is by using a budget tracking tool like Mint.com or creating your own spreadsheet to keep track.

Creating a credit card spreadsheet doesn’t have to be complicated or fancy; you can use an Excel spreadsheet if you want or find a free template online for credit card tracking.

When you are creating your spreadsheet, you might as well make it comprehensive to keep you in good standing with your credit cards.

Before starting, gather up all your credit cards to add and all the bills and subscriptions you pay with each credit card.

How can I use my own spreadsheet to track subscriptions?

Making your own spreadsheet is always a good idea, even though it is very manual. You will be able to organize the information that is most useful to you and in a way that makes sense for you.

The downside is that you will likely need to keep the data fresh. Most people will do this monthly, but quarterly can be sufficient if you are willing to dedicate an afternoon to the task.

This method is also wonderful if you are interested in “credit card churning”. This is a fancy way of taking advantage of sign-up bonuses and points to maximize your credit card earnings.

Here are some columns you will want to include in your spreadsheet:

- Card issuer

- Card name

- Card owner (If you and your spouse have joint cards)

- Open date

- Expiration date

- Credit limit

- Annual fee

- Rewards earned from the card

What is a recurring payment?

A recurring payment on your credit card is when you have given a company permission to charge your credit card regularly for a service or a product.

Common recurrent charges would be things like gym memberships, utilities, and entertainment services. In addition, many people have started to order their daily household products or even clothing through these automated services!

You may be surprised to find subscriptions you have long forgotten about and no longer use, but are still paying for on a regular basis. So, how do we get rid of these long-forgotten subscriptions?

The first step would be to identify all the services you have charged to your card. Then you need to decide which services you no longer need and which ones are still important to you.

One of the easiest ways to identify the services that you will need to cancel is through a worksheet. Worksheets are a simple but effective tool for quickly finding recurrent charges on your bank statements.

You can save yourself some time by thinking through some of your current subscriptions. That is why I’ve created a free worksheet to help guide you through this exercise!

Eno will also notify you when the free trial period is over for a subscription. This gives you time to cancel if you don’t want to continue with that particular subscription.

Final thoughts on canceling credit card subscriptions

Canceling credit card subscriptions may seem like a daunting task, but with the right knowledge and tools, you can successfully navigate this process.

In this article, I shared five effective ways to cancel your credit card subscriptions: online, by phone, contacting your bank, utilizing tracking tools, and considering the option of changing your credit card.

Each method offers its own advantages and considerations, allowing you to choose the approach that best suits your needs and preferences.

Remember to review your subscriptions regularly and make adjustments as needed. With these insights, you can confidently manage your credit card subscriptions and make informed decisions that align with your financial goals.

Have you ever had difficulty canceling a credit card subscription? What steps did you take to resolve the situation?

What other strategies do you use to keep track of your credit card subscriptions and manage your finances effectively?