Retained earnings are often referred to as the lifeblood of a business, yet many small business owners and entrepreneurs overlook their significance. Understanding and effectively managing your company’s earnings can be the key to unlocking sustainable business growth.

If you’re an entrepreneur or small business owner wondering how to leverage your company’s profits to fuel expansion, this guide is for you. You’ll learn what retained earnings are, why they matter, how to calculate and grow them, and see real-life examples of businesses that have harnessed their power for success.

What Are Retained Earnings?

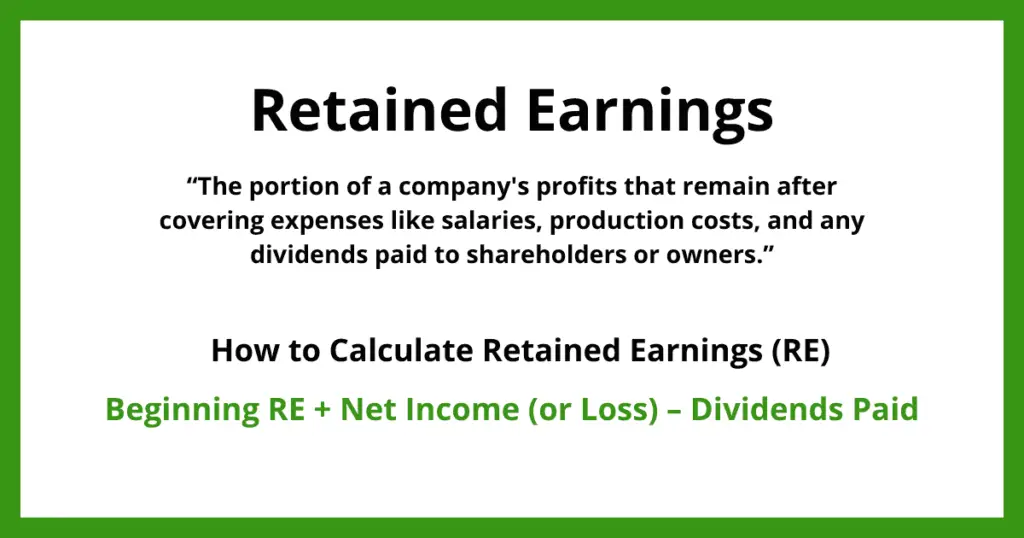

Retained earnings refers to the portion of a company’s profits that remain after covering expenses like salaries, production costs, and any dividends paid to shareholders or owners. In other words, it’s the profit a business keeps to reinvest in its growth rather than distributing it.

Sometimes these are referred to as retained trading profits, these funds are considered a form of equity on the balance sheet, reflecting the company’s overall financial health and worth (value).

How your small business utilizes its retained earnings can significantly impact its success. Strategic reinvestment can drive growth, while poor management of these funds may hinder long-term sustainability.

How to Calculate Retained Earnings

Calculating retained earnings is straightforward and follows a simple accounting formula:

Retained Earnings = Beginning Retained Earnings + Net Income (or Loss) – Dividends Paid

If you use accounting software, it will automatically calculate this for you when generating financial statements like the balance sheet or the statement of retained earnings. However, if you are calculating it manually, you will need to determine the following three variables before plugging them into the equation above:

- Beginning Retained Earnings: This is the balance from the previous accounting period. If you prepare a balance sheet monthly, for example, you will use last month’s retained earnings as your starting point.

- Net Income or Net Loss: This comes from your income statement for the current period. If your company is profitable, this number will be positive; if it incurs a loss, it will be negative.

- Dividends Paid: This represents the portion of profits distributed to shareholders. If your company issued cash dividends, the total amount paid is deducted from retained earnings.

Example Calculation:

Let’s see how this formula works in practice.

Suppose a company starts the year with $80,000 in retained earnings. Over the year, it earns $30,000 in net income and distributes $10,000 in dividends to shareholders.

The calculation would be:

- Beginning Retained Earnings: $80,000

- Net Income: $30,000

- Dividends: $10,000

Retained Earnings = $80,000 + $30,000 – $10,000 = $100,000

At the end of the year, the company has $100,000 in retained earnings, which can be reinvested into the business, whether for expanding operations, purchasing equipment, or reducing debt.

For small businesses, the dividend amount would be the amount paid out to owners. Even if you are a sole proprietor or a freelancer, it is a good idea to set aside retained earnings for future growth.

Why Retained Earnings Matter for Your Small Business

Retained earnings are more than just numbers on a balance sheet, they are a key resource that can shape the future of your business. Here is why they matter:

Safeguarding Business’ Financial Stability and Flexibility

Retained earnings help to maintain a company’s financial health, offering both stability and flexibility. By retaining earnings, businesses build a financial cushion against unexpected challenges, such as economic downturns or operational setbacks.

This accumulated reserve acts as a safety net, reducing the need for external financing and allowing businesses to sustain essential operations without disruption.

For example, during an economic recession, businesses with strong cash reserves can continue investing in their stability and growth, while competitors may struggle to secure funding or be forced to cut costs.

Funding Growth and Expansion

Retained earnings provide a valuable internal funding source for business growth and expansion. Instead of relying on external financing, companies can reinvest their profits into key initiatives such as purchasing new equipment, expanding production capacity, or opening additional locations.

This self-sustaining approach not only reduces dependence on external funding or issuing new shares but also fuels growth by helping businesses maintain control over their operations and avoid diluting existing shareholders’ ownership

For example, a software business can leverage its retained earnings to develop new software products, which will lead to increased revenue and profits in the future.

Increased Shareholder Value

Retained earnings play an important role in boosting long-term shareholder value. When businesses reinvest their earnings, it signals confidence in future growth and strengthens the company’s financial position. As profitability increases, so does the value of each share, benefiting existing shareholders.

Additionally, reinvesting earnings can generate higher returns, further enhancing shareholder wealth. For example, a technology company that channels earnings into research and development may create innovative products and drive up stock prices.

Dividend Stability and Growth

Retained earnings are essential for maintaining stable and growing dividends, which can enhance investor confidence and attract long-term shareholders. Businesses with a healthy reserve can continue paying dividends even during economic downturns or temporary setbacks, avoiding sudden reductions or elimination of dividends that might unsettle investors.

Additionally, businesses that consistently grow their earnings are more likely to increase dividend payouts over time. This makes them more appealing to income-focused investors seeking reliable returns.

Debt Repayment and Financial Independence

Retained earnings provide a powerful tool for reducing debt and achieving the business’ financial independence. By paying down outstanding obligations, businesses can lower interest expenses and strengthen their balance sheets. This not only improves creditworthiness but also enables companies to secure better loan terms, such as lower interest rates or extended repayment periods.

For example, a manufacturing company that leverages earnings for debt reduction is positioned for long-term growth and resilience through enhanced financial stability and minimized risk of default. Moreover, it can boost investor confidence by demonstrating strong fiscal management.

Strategic Acquisitions and Investments

Retained earnings give businesses the financial opportunities to pursue strategic acquisitions and investments. By retaining earnings over time, businesses can build a strong reserve to fund mergers, acquisitions, or joint ventures without relying on external financing.

These strategic moves can open doors to new markets, diversify product offerings, and strengthen competitive positioning. For example, a retail company with substantial earnings might acquire a smaller competitor to increase market share and achieve economies of scale.

NOTE: The most effective way to use the surplus depends on your business goals. If your company is in a growth phase, reinvesting in expansion might be the best move. For more established businesses, reducing debt or rewarding shareholders could be a priority.

How to Grow Your Retained Earnings

Increase Revenue and Reduce Costs

The simplest way to grow retained earnings is by increasing revenue while reducing costs. Simply put, this means boosting net income by expanding your customer base, introducing new products or services, or making strategic price adjustments.

At the same time, businesses should implement cost-reduction measures to maximize profitability. This may include optimizing advertising expenses, negotiating lower rent, and streamlining personnel costs. By balancing revenue growth with the above-mentioned smart cost management, small businesses can steadily build their retained earnings and ensure long-term financial stability.

Manage Debt Effectively

Effectively managing debt is always important, and it can play a major role in increasing the amount of money you take home. High levels of debt can eat into profits and limit the funds available for reinvestment and growth. To maintain financial stability, businesses should set a clear goal to reduce debt whenever possible.

By keeping debt under control, small businesses can improve profitability and steadily grow their revenue surplus.

Invest in Financial and Accounting Management Software

The importance of using financial and accounting management software is often overlooked. While most companies use software such as Quickbooks, stakeholders sometimes forget to look at the provided reports. Understanding this data can help you significantly improve a business’s financial health.

Some financial software also provides accurate financial forecasting and detailed cash flow management. By using these insights to make informed decisions, small businesses can optimize earnings and ensure long-term financial growth.

Monitoring Expenses

Once you have proper software in place, tracking expenses becomes much easier. Keeping track of expenses is essential for maintaining profitability. Regularly reviewing costs and identifying areas for savings can prevent unnecessary spending.

Additionally, keeping good records of business expenses may allow you to write more costs off when tax season rolls around. More write-offs then lead to more money in shareholders’ pockets.

Reinvesting Wisely

Strategic reinvestment in the business, such as upgrading technology, expanding operations, or enhancing employee training, can drive growth and increase profitability. Thoughtful reinvestment ensures sustained success while growing earnings over time.

A common misconception about reinvestment is that it solely includes buying new inventory or equipment. However, giving employees a raise, paying for their health insurance, or improving training are also means of reinvestment.

Retained Earnings Can Be Your Growth Engine

Retained earnings are more than just a line in your financial statement, they’re a testament to your business’s strength and future vision. From funding future projects to safeguarding financial stability, understanding and leveraging retained earnings is a skill every small business owner should master.

By following strategic steps, monitoring expenses, and reinvesting wisely, you can unlock the full potential of your profits and set your business on a path to sustainable growth.

Have insights or experiences with managing retained earnings? Share your story in the comments, your advice might inspire someone else in their entrepreneurial journey!