What is Passive Income?

Passive income, also known as residual income, is an income source where the person is not actively involved. It is a source where there is little to no effort put into obtaining that income on a regular basis.

Many times, passive income is described as a way to “make money while you sleep.” Another way of describing it is that it is a great way to “make your money work for you”. Although it may take effort to set up, you can rest easy knowing that you are earning money without even having to think about what you are doing!

In this post, I will share what you need to know about what is passive income for tax purposes, easy ways to get started, and how it can lead you to early retirement.

Table of Contents

- What is Passive Income?

- What is passive income for the IRS?

- Why Should I Have Passive Income?

- How can a beginner make passive income?

- How can I make $1,000 a month in passive income?

- How to manage passive income well

- How much passive income do you need to retire?

- Launch yourself into passive income

- Test your knowledge with this passive income quiz!

What is passive income for the IRS?

The IRS (Internal Revenue Service) has specific guidelines for how it decides what is passive income and how to file taxes on it. It doesn’t have to sound scary! This can actually be a simple process if you pay attention to their requirements. Here is what you need to be aware of:

- Rental properties: If you own a piece of property where you are now receiving an income through renting it to someone, you are then considered to be making passive income. It is important for you to keep all of your documentation so that you can provide all the information you need for your taxes.

- Business Investments – “No Material Participation”: If you have ever invested funds into a company and have taken a percentage or stake of that company, then this is considered passive income. The “material” part of no material participation means that you are not present in the day-to-day operations of the business beyond the investment. You may be using that percentage to help you earn back your investment but it is still considered an inactive way of making an income.

As you can see, the IRS answers the question of “what is passive income” a bit differently than what most of us consider to be passive income. This is great because it makes accounting for taxes much easier!

Why Should I Have Passive Income?

When you sit down to think about how you make money, one of the most important factors you should consider is diversifying your income streams. Diversifying your income may sound like a lot of work, but in the long run, it is a sustainable way to help you ensure you are earning the most you can!

Diversifying your income simply means that you have more than one way of making money. You may have a 9-5 job that has a good salary but by incorporating other methods, such as including passive income, it can help you meet your financial goals sooner.

Using passive income as one of your streams to help you bring in money will help you achieve retirement earlier than planned, protect you if you lose your day job, and help you increase your own wealth.

How can a beginner make passive income?

Let’s cut to the chase, here are some of the most common ways to make passive income. Of course, there are many different ways beyond this list but many well-off people will have at least 2-3 of these passive income sources.

Easy Passive Income Examples:

- Dividends from Stocks

- Interest from savings accounts

- CD Ladders

- Creating digital assets that you can sell (leveraged income sources include: ebooks, digital calculators, apps etc.)

- Rentals (housing, cars, etc.)

- Sign up bonuses and cashback rewards cards (also known as credit card churning)

- Vending machines; (I had a gumball machine when I was 10 and brought in an easy $100 a month!)

- Ads- adding ads to a website is a very easy way to make money passively

- Affiliate marketing- just like your favorite Youtubers, you can have your own affiliate codes for products you know and love!

- Invest in a business- your own or someone else’s!

How can I make $1,000 a month in passive income?

The best way to make $1,000 a month in passive income is by creating multiple income sources. Chances are, you will need to use at least 3 of the examples from above to generate $1,000 a month passively.

If you are nervous about beginning, you can start by checking out your local bank branch or talking to a wealth management advisor. In the long run, you will want to manage your investments yourself to reduce fees. That being said, these initial conversations are typically free, and meeting with a professional is a great way to start creating a specialized plan that will help you learn where to begin.

I like to start with investments as a passive income stream because it is pretty easy to start and anyone can do it. Nothing feels better than learning how to use your own money to make you money! If you are looking for more ways to start, check out these articles on how I saved my first $1,000 in a month while I was was still in college and how I was able to invest my first $1,000.

Optimize your life to learn how to make multiple income streams

After you’ve collected some free advice and done your initial investing research, I would then take a look at the various areas of your life to see where you might be able to earn a little easy money.

Most people dislike investing because they feel like it detracts from their lifestyle or because they can’t afford it. If you start your investment accounts by finding the money in creative ways, then it starts to feel more like a game!

A lot of people choose to get started with multiple income streams by investing into properties. Sometimes its nice to have a physical representation of your money! You can look into this by region, for example there are indianapolis investment property for sale. This is a great way for the average joe to start getting into the real estate market with Ben as your guide!

Find money making objects!

Pro tip: best passive income streams are often inanimate objects. I write a lot about how I started my gumball machine business as a kid and started earning around $100 to $200 per month passively.

Do you know what else was next to my gumball machine? My Dad’s ATM machine was also in our ice cream store! He was also making money passively each time someone was making a transaction. Additionally, once people knew an ATM machine was there, it often drove traffic to the store. And who can walk out of an ice cream store without buying something?

While both of these might not be as easy to get into without having your own store front, you can still find ways to make money passively. For example, you can try to earn passive income by selling credit card processing! By partnering with stores in your area, you can easily earn a small percentage of each transaction they do each day.

Leverage those income streams to jump-start more passive income streams!

You can then use the money that you found into either creating passive income streams through investing or by leveraging them into other passive earning opportunities. Are you good at talking? Maybe starting a podcast can be a fun way to start a small side income!

And all you need to start is an initial investment of around $50 for a decent USB microphone and some free editing software. And let’s be real, many podcasts were started using built-in microphones on computers or headsets. So you don’t even need to put money into it at first if you don’t want to!

You can take a week or two to record all of your episodes and then schedule the uploads and promoting. By front-loading your work, you can start to automate your income streams and are one step closer to passive income!

Maybe you like managing and would love to invest in a rental? This is the time to use all your skills in DIY and renovations and create a highly requested rental property where you can rest easy knowing you are bringing in monthly income.

The key to passive income is to remember that it takes work, in the beginning, to set up. But it won’t require constant work once it is set up! Your hard work will pay off in the end and much quicker than you might expect.

How to manage passive income well

Now that we have learned the answer to “What is Passive Income” and have learned a few ways you can get started, let’s discuss ways you can manage your newfound money.

- Remember your time: The keyword in passive income is passive. It shouldn’t be a source where you have to put in a lot of time and effort, otherwise, it is turning into a side hustle. You want to ensure that when you are planning your passive income stream, you are ensuring that you are planning how you will slowly start to back away and let it maintain itself.

- Have fun with it!: The great thing about passive income is that there are so many options for you to choose from! While you are assessing your skills and planning out what you want to do, make sure you are having fun with it! Invest in companies you truly believe in or create a course on a subject that you love. The options are endless but the main point is that you are enjoying the process.

- Automate it: The more passive you can make your income, the better! Once you’ve started making passive income streams, it is great to have automatic investing set up as well. And we all know what happens when you invest…Even more passive income in the form of dividends!

- Invest it: The key with investing is that it allows your money to maintain its value over time. Otherwise, your hard earned dollars can loose value due to inflation! Investing can be fun and even match your interests. One fun way to get started would be to look into artificial intelligence stocks under $10. You don’t need tons of money to get started with investing and there are so many new things to get in on at “the ground floor”!

How much passive income do you need to retire?

Passive Income takes on a new and more exciting meaning when you consider retirement. In the US, the current full retirement age is 66 years old, however, you can retire much earlier than that if you are able to completely replace your active income streams. You might be wondering, “what is passive income when it comes to early retirement”?

Luckily, there are numerous studies on how to calculate how much passive income you need to retire. The most popular study, The Trinity Study, found that you would need about 25 times your annual expenses to retire. This number would allow you to safely withdraw 4% of your money from your investments each year without decreasing your initial investments.

Of course, there are a lot of variables that go into how much passive income you might need to retire early. If you have hobbies that happen to make money, investments that fluctuate often, or are planning to increase your lifestyle, then you might need a much different calculation. Remember, personal finance is personal! You should always look into what would make the most sense for your unique situation.

Here is an example of passive income for early retirement!

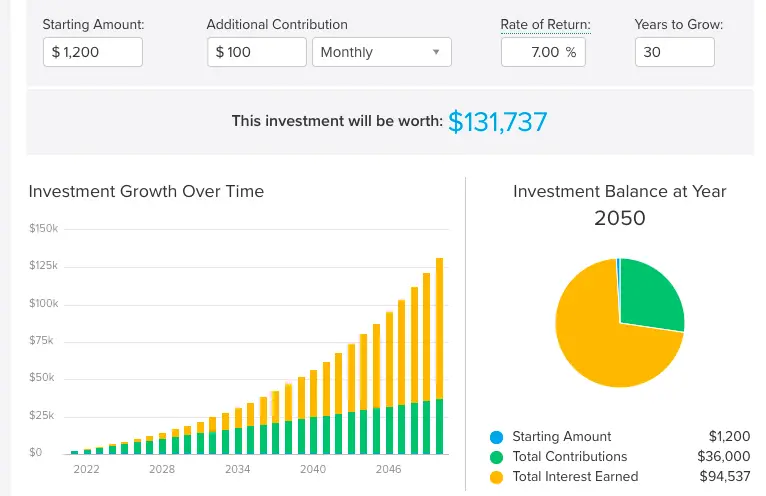

Let’s break down the Trinity Study’s 4% rule into easier-to-understand terms. If you spend $50,000 each year then you would likely need around $1,250,000 to retire! Luckily, you do not need to save all that money yourself! By investing early and often, you can typically expect your investments to increase at an average rate of about 7% each year.

Retirement can feel very far away and saving up such a large sum of money can seem like a big task. Passive income allows you to feel certain that you can meet your retirement goals and continue to save for the retirement of your dreams!

If you can create even $100 a month passively for just one year, that is $1,200! Even better, if you continue to invest $100 a month, assuming you obtain the market’s average annual return of 7%, you will have over $130,000 after 30 years! So not only have you earned the initial money passively, by investing you create another passive income stream in the form of dividends and investment growth!

Launch yourself into passive income

Passive income is an incredible way for you to increase your wealth. This revenue stream is a way to help you meet your goals for retirement (and maybe even retire early!). I fully believe that passive income should be a part of everyone’s income source.

Taking time to put in the effort at the beginning of your journey will set you up for long-term success. Remember, no income stream comes with no work. Setting your passive income stream up will allow you to relax and watch your wealth grow in the future.

Ensure that what you decide to do is something you enjoy and also a source that won’t take a lot of time to maintain. You should not be actively involved in the daily maintenance of this income stream but instead enjoying the joys life has to offer.

Make money work for you. You are a hard worker and deserve to have your money work for you. The time is now! Don’t sit on this income source but instead seize the opportunity and be on your way to full financial freedom.

Test your knowledge with this passive income quiz!

How many passive income streams do you have? Do you have any that aren’t on the list from above? Share your tips in the comments section!

Kathryn Rucker is a sales consultant and content writer. With 7+ years of sales experience, she is passionate about helping businesses and individuals grow their sales pipelines by improving their online presence.

She has been traveling full-time since 2018 thanks to the location and financial independence she has gained from her business, Kat Rucker Consulting Group. You can connect with her on LinkedIn.

Disclosures and Disclaimers: The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a duly licensed professional for investment advice.

3 thoughts on “What is Passive Income? (10 Easy Ways to Get Started!)”