I’ve definitely had to wonder, “Is debt consolidation a good idea”, multiple times over my financial journey. This may be a personal finance blog, but like many people, I still carry a bit of debt. I graduated from college in 2017 with almost $30,000 in student loans. I also had a small amount of my living expenses on a credit card.

Debt is no joke and in many cases consolidating it can make it more manageable. When I graduated, the first thing I did was look into the various options I had for paying my debt down faster. For me, I ended up not consolidating as most of my loans already had a low interest rate and were subsidized by the government.

That being said, I learned a lot about consolidating debt that can help you answer the question of if debt consolidation is a good idea for you! Read on to learn more about how debt consolidation works, the pros and cons, and other important things you should consider.

Table of Contents

- How Debt Consolidation Works

- How to destroy your debt by consolidating!

- Is Debt Consolidation a Good Idea?

- The Pros and Cons of Debt Consolidation

- What are the Advantages of Debt Consolidation?

- What are the Disadvantages of Debt Consolidation?

- Will Debt Consolidation Help or Hurt My Credit?

- How to Consolidate Debt

- Where to consolidate debt

- Is debt consolidation a good idea for you?

How Debt Consolidation Works

Debt consolidation is the process of combining multiple sources of debt, and sometimes different types of debts, into one amount. This amount takes the form of a new loan that consolidates your debt into one location by paying off the prior loans.

According to CNBC, the average American has $90,460 in debt. Using debt consolidation and other personal finance tools could decrease the amount of time it would take you to pay this off.

Many people have their debts spread across various accounts and with different lenders. This makes it hard to keep track of and can result in missing payment dates. That is why a debt consolidation loan can be a powerful tool for managing and organizing your total debt load!

How debt consolidation can save you money

By combining different debt amounts that can all have different interest rates, you could end up saving money. That is because the various interest rates will merge into just one interest rate!

This new rate may be lower than the interest rate on your largest debt. By consolidating you may be able to pay less interest as you pay things off. At the same time, more of your money will be going to the principal balance. So you will save a little that way as well!

There are a few different ways that you can consolidate any debt you have. The options you have for consolidating vary depending on the kind of debt you are carrying. That is why it is so important to do your research beforehand!

How to destroy your debt by consolidating!

As the title mentioned, this post is about destroying your debt by consolidating. It is important to remember that you can implement many different methods to obtain a debt-free life!

Here are some actionable steps you can take towards destroying your debt:

- Find the right headspace

Everyone is different, but we all need to be motivated by something to accomplish our goals. Crushing debt can be a long boxing match, but you’ve got this!

- Focus on Long Term Lifestyle Changes

If your ship has a hole at the bottom of it, then it doesn’t matter how much water you toss out with a bucket. Have an honest conversation with yourself about how you accumulated so much debt in the first place. Find out if you spend to deal with your feelings, because of poor planning, or because of poor impulse control then you need to know that.

- Build a Budget

You likely got into debt by not keeping track of your spending. It makes sense that a budget is going to help get you out of it! There are so many different kinds of budgets out there. You should be able to find one that is fun or works with your new lifestyle! Once you get things in order, this will become second nature and you may no longer need a special system.

- Beef Up Your Emergency fund

If you don’t have at least one month’s expenses saved up, then you are probably living paycheck to paycheck. This means your whole plan can be derailed by sudden emergencies. Keeping an emergency fund brings peace of mind and will help you stay on track no matter what.

- Get an Accountability Buddy!

If you take away anything from this post, I hope it is the knowledge that you aren’t alone. Find a friend who is paying off debt and challenge them to beat you to it! You can even use percentages towards completing your goal to make things more fair and private.

- Pick Your Milestone Treats

If you completely deprive yourself of the things you love, then you are setting yourself up to lose. The best part is, by making a lifestyle change you’ve already made these treats sweeter. For every $1,000 you save, go out for a movie! Make sure you keep them reasonable, but fun!

- Research Your Options

It’s weird to think, but when you consolidate you are actually in a position of power. Whoever loans you money is making their profit off of the interest that you pay! This means that many companies are interested in competing for the privilege of providing you a loan.

Be sure to shop around and find a company that offers you a good interest rate, favorable payment plans, and doesn’t charge too many fees.

Is Debt Consolidation a Good Idea?

Deciding if debt consolidation is a good idea really depends on your personal financial situation. The top things to consider are if you will be able to afford the new monthly payment amount, how the new loan may impact your credit score, and if your income is stable enough to see the payments through.

If you have a large number of private loans then debt consolidation can make your personal finances much simpler. This is especially true if your loans are with many different companies!

On the other hand, if most of your debt is student loans, then you should be extra careful before refinancing. Depending on your loan type, you can lose some of your protections and repayment options if you refinance.

Generally, consolidating debt can make things much easier for the borrower. Many people are overwhelmed by their financial situation and sometimes having one account, with one provider, and one due date is all that is needed to help them get organized.

The Pros and Cons of Debt Consolidation

When it comes to answering the question, “Is debt consolidation a good idea?”, the simplest way to find your answer may be through a good old-fashioned pros and cons list.

Money is not always a numbers game. You also have to carefully analyze your habits, be honest with how well you are able to stick to a plan, and if there are options you have available to you such as the debt avalanche/snowball methods.

Unfortunately, there is no clear-cut answer to this problem as there can be many factors to consider beyond the debt. Here are the advantages and disadvantages of debt consolidation that you should consider before combining your debts.

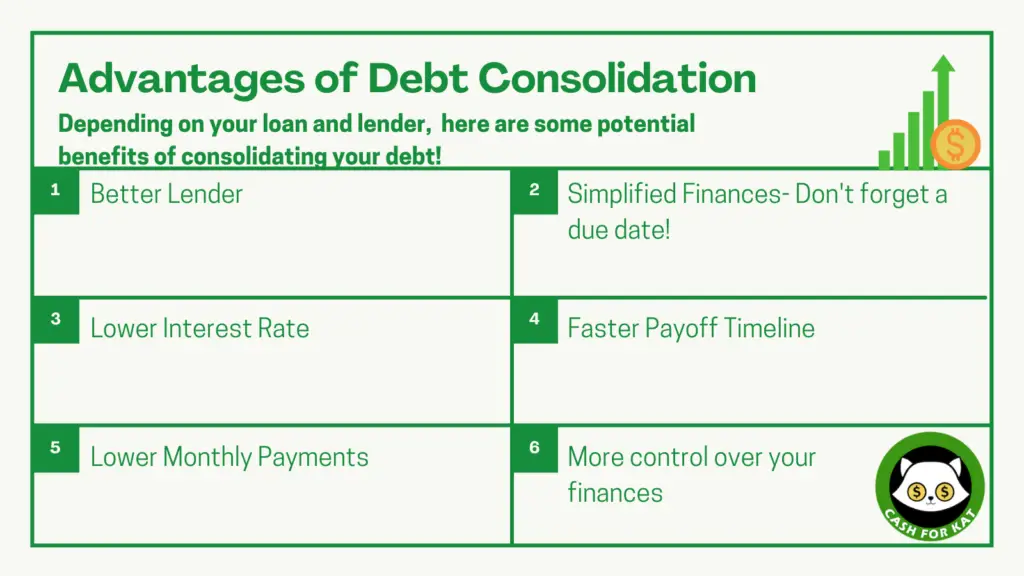

What are the Advantages of Debt Consolidation?

Debt consolidation comes with many benefits, but you are still taking out a big new loan. Before you take that plunge, you may want to consider all of your repayment options.

If the idea of paying off one big loan is intimidating, then you might want to consider other methods of debt paydown such as the debt snowball or avalanche methods. Since these methods advise paying off loans in a certain order based on size and interest rate, they may be more useful if you are not ready to consolidate.

Now, let’s dive deeper into some of the advantages of debt consolidation!

Choosing a better lender

If you have student loans, often you do not get to decide on which provider will be servicing your loans. Something similar can be said for personal loans or sudden credit card debt from emergencies. Chances are, you may have gotten your loan because you were in a sticky financial situation and did not have much time to shop around.

If you are considering consolidating, this is the best chance for you to find an organization that is a better fit for your lifestyle. Remember, a supportive customer service hotline can make a world of difference in making you feel more confident about your repayment plan.

You’ll also want to be sure to double-check the qualifications of your lenders. For example, Cash On Your Mobile clearly states on their website that they have been issued an Australian Qualification License and share their credential numbers. This is just one of the things you should check for when vetting your lenders!

Single and potentially lower interest rate

Each of your debts likely comes from different lenders and were taken out at different times. This means they likely come with different interest rates. Even in locations, such as looking at personal loans Canada, can change the interest rates offered. Merging your loans together in debt consolidation will likely result in a singular lower interest rate.

For example, if you have good credit and choose to consolidate on your own through a balance transfer credit card then you could enjoy a 0% APR. This is a wonderful perk to take advantage of if your credit score is high enough to qualify!

Lower monthly payments

There are many ways to lower your monthly debt payments. One option to help you make monthly savings with debt consolidation is using your home or other assets as collateral. This can often extend your repayment timeline, which can provide greater financial flexibility and breathing room.

It’s important to review the terms of your loan carefully to ensure it aligns with your long-term financial goals. If you plan on paying more than the minimum, you could reduce the principal balance quicker and save even more in the long run.

Avoid being harassed

No one likes having debt collectors ringing them all day and night! Consolidating your debt might be a wise move as you will decrease the number of companies that you have to deal with.

That being said, there are some laws regarding the times in which your debt collectors can call you.

There are also resources available, should you feel that you are being pursued unfairly or to heavily. One option is to look into a Debt Collection Harassment Attorney. They know the ins and outs of the legalities of debt collection.

Some even function across state lines, which is useful if you have moved over the years!

Less chance you will forget a payment

If all your sources of debt are in one easy-to-access location, it is a lot less likely that you’ll forget to make a payment. You can even set up automatic payments without having to worry as much about over withdrawing your account.

Could speed up the time it takes you to pay it off

Since you’ll likely enjoy a lower interest rate, this means you can make extra payments each month from the savings. If you have debt, your constant goal should be to pay it off as quickly as possible.

What are the Disadvantages of Debt Consolidation?

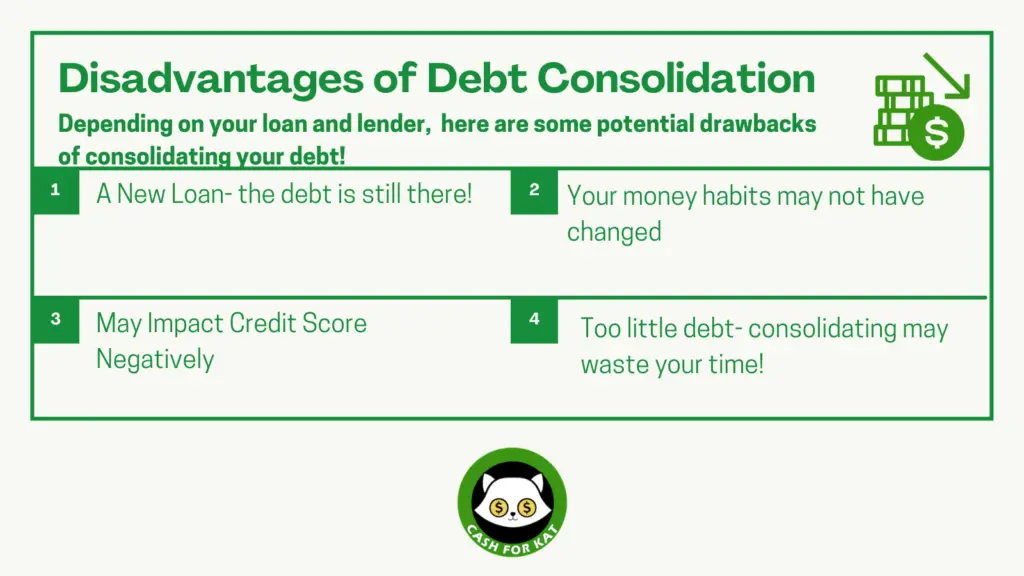

After all these positives, you might be wondering, “Why are some still wary of debt consolidation?” Debt consolidation can become a negative choice for many reasons, mainly related to your personal spending habits.

A new loan

By debt consolidating, you’re not getting rid of the debt, you’re simply condensing it into a new loan. This new loan may have different terms and conditions compared to any previous ones.

If your credit score has gone down since first collecting debt, the new loan could have a larger negative impact than your past loans. It is important to be sure you are aware of all the fine print of this new debt consolidation loan. It can be easy to make mistakes, so don’t be afraid to ask questions!

Could potentially impact credit score

Your credit score looks at various factors, including how many loans you have and how long you’ve had them. Credit history has a huge impact on your credit score and consolidating may result in closing some of your older accounts. This will likely have a negative impact on your score, especially as your consolidation results in a new loan as well!

If you are looking to qualify for a house, take out loans for school, or apply for new credit cards around the time you plan on consolidating be sure to look into this carefully. If you aren’t trying to qualify for new loans, then consolidation may still be a good option.

Even though your score will dip, it is temporary. Your score will go back up over time as you continue to manage your debt responsibly.

Debt can become worse if habits haven’t changed.

If you’re someone who does not have good spending habits, debt consolidation may not make a difference. You really need to identify how you ended up in debt, why your spending got out of control, and create a plan to combat these habits.

Too Little Debt

If your debt is already small, it won’t be worth it to consolidate. If you only have a few payments left on a few different loans, it could be detrimental to take the time to combine these. There is a chance that you could have already had them paid off by the time the new loan is available!

Will Debt Consolidation Help or Hurt My Credit?

When you first consolidate your debt, your credit score will see a temporary dip. These dips usually happen whenever you check your score through a hard inquiry. This applies regardless of if you obtain approval or disapproval for a new line of credit!

This temporary dip is normally small and only affects your score by just a few points. After you begin making on-time payments, your score will quickly recover. In fact, you could see it grow even higher than it was previously!

The lesson here is that debt consolidation will only help your credit if you are able to make on-time payments, budget effectively, and make intelligent credit decisions outside of the debt consolidation loan.

Debt settlement vs. Debt consolidation

As this article has shared, debt consolidation is the process of reducing the number of loans by using a new loan to pay them off. Debt settlement is a bit different and can be extremely useful if you find yourself with much more debt than you can handle.

Unfortunately, debt settlement can be a much more risky option as it involves withholding payment from your creditors until you become severely past due (Aka delinquent). This makes your creditors much more likely to settle your total bill for pennies on the dollar.

For this option, you can either try to settle yourself or utilize a company to help you negotiate. These debt settlement companies may have you put money aside into a separate account to save for an in full payment while you wait to reach a settlement.

Be very careful if you decide to go in this direction. If your credit score is already bad or your accounts are already in collections, then this may be an option. Either way, be sure you have researched the company extremely carefully. The Federal Trade Commission (FTC) has had to shut several down for taking advantage of borrowers.

How to Consolidate Debt

To successfully consolidate your debt, you have a few options. The main difference in deciding on a strategy really depends on the kind of debts you’re carrying. Consumer debt, student loans, mortgages, etc. may have different consolidation methods available.

One common and obvious option is to find a lender who can provide one big loan that allows you to pay off all of your smaller loans. This is great because now your debt is in one place, with one monthly payment, and one fee. This can also have a huge impact on your credit score because you are closing out many of your older accounts at the same time.

Another way to consolidate debt would be by taking out a loan from a 401(k) or your home equity (through debt consolidation mortgages). This can be very risky as you could jeopardize your retirement or housing situation if you do not change the underlying habits that put you in debt in the first place.

Often these options come with penalties and repayment plans, so make sure you speak with a professional before doing anything permanent.

How to consolidate credit card debt

According to Debt.org, the average household credit card debt in America is $5,315. That is why I thought it would be useful to create a special section that tackles this issue. Luckily, it is very easy to consolidate this kind of debt and often with favorable terms.

For consumer debt like store cards or credit cards, you may want to do a balance transfer to a new card. Like above, this can negatively impact your credit score if you close the old cards. An alternative would be to do the balance transfer and then stop using the old cards so you do not dig yourself a deeper hole.

A new card can often come with perks such as a 0% APR for 12 months, which can really help you pay things off faster if you are disciplined. Make sure you do not get charged too much on the initial balance transfer!

Where to consolidate debt

Most people prefer to consolidate their debts with their current bank. This keeps all of their finances in one location and often expedites the payment process. Other options would be finding a provider that specializes in debt consolidation.

Either way, you have a lot of options and should definitely shop around! As mentioned before, these companies are competing for your debt and you can use that to your advantage.

Here are some lists of the best debt consolidation options:

- NerdWallet’s best debt consolidation loans

- Forbes’ list of best debt consolidation loans

- Credit Karma’s list of best debt consolidation loans

- Debt.org’s best debt consolidation loans, companies and programs

Here are some debt consolidation calculators:

- NerdWallet’s debt consolidation calculator

- Well’s Fargo’s debt consolidation calculator

- Bank Rate’s debt consolidation calculator

Is debt consolidation a good idea for you?

Debt consolidation may be a tempting endeavor at first glance; however, you will need to ensure that it is the correct choice for your personal finances. Comparing the pros and cons of debt consolidation to your unique situation can help you decide if obtaining a debt consolidation loan is right for you.

To learn more, be sure to read the Federal Trade Commission’s (FTC) guide on Coping with Debt. They provide information on debt settlement programs, debt management plans, and credit counseling. In addition, they provide guidelines on disclosure requirements and how to avoid scams.

Have you ever consolidated your debt? Do you think debt consolidation is good or bad? Let me know in the comments!

1 thought on “Is Debt Consolidation a Good Idea? Destroy Your Debt!”

Comments are closed.