When it comes to paying off debt, there are many different methods and challenges you can try. In this article, we’ll discuss 10 Debt Paydown Challenges that can help you get rid of your debt quickly.

These challenges range from the simple (such as the Debt Snowball Challenge) to the more complicated (such as saving $10,000 in a year). All of these challenges are great for those of you who are trying to become debt-free!

If you’re not sure where to start, don’t worry – we’ll go over each challenge in detail. And if you have any questions, be sure to leave a comment at the end of this article.

Table of Contents

- So what’s the best way to pay off debt?

- Debt Paydown Challenges

- No Spend Challenge

- The Debt Snowball Challenge

- Debt Avalanche Challenge

- 30-Day Debt Loss Challenge from Credit Karma

- Car Loan Payoff Challenge

- Save $500 in a Month Challenge

- Save $1000 a Month Challenge

- Save $10,000 in 52 Weeks

- Challenge Your Friends

- Debt Elimination Challenge

- Final thoughts on debt paydown challenges

So what’s the best way to pay off debt?

Debt payoff can be a scary thing for most people. Whether it’s student loans, a credit card, or a car loan, most people are trying to clear up at least a couple of thousand dollars in debt.

According to a recent study by Experian, the average American has $5,525 in credit card debt alone. And that doesn’t even include mortgage or student loan debt.

I find that the most effective way to pay down debt is when you feel like it is a bit of a game. At the end of the day, you need to find a way to stick to your debt payoff plan and gamification can be a great way to get there. It is not fun to feel like you are missing out on things, which is why it is so important to reframe debt paydown into something positive.

Below, I’ve included some of my favorite types of debt paydown challenges. The best part is that you can modify all of these to make them easier or more difficult depending on your personal goals!

Debt Paydown Challenges

There are so many debt paydown challenges to choose from but they all have a pretty similar end result: saving more money even if you have no self-control! What usually makes debt paydown a fun “challenge” is by putting a time limit on things.

Ultimately, adding a time limit is what helps you accomplish the goal faster. It also is more fun because you can easily see how much money you’ve saved compared to what you would have saved if you just paid the minimum on your debt every month.

Here are my top ten debt paydown challenges

- No Spend Challenge

- The Debt Snowball Challenge

- The Debt Avalanche Challenge

- 30-Day Debt Loss Challenge from Credit Karma

- Car Loan Payoff Challenge

- Save $500 in a Month Challenge

- Save $1,000 in a Month Challenge

- Save $10,000 in 52 Weeks Challenge

- Challenge Your Friends

- Debt Elimination Challenge

No Spend Challenge

The No Spend Challenge is a great way to get your spending under control. The premise is simple: for an entire month, you don’t spend any money on anything other than the essentials (food, rent/mortgage, utilities, etc.).

This challenge can be tough if you’re used to spending a lot of money each month on things like dining out, shopping, and entertainment. But it’s a great way to start getting your finances in order.

In fact, some people have even taken this challenge to the extreme and have done no spend YEARS! So if that doesn’t motivate you to try and tackle a 30-day no spend, I don’t know what will!

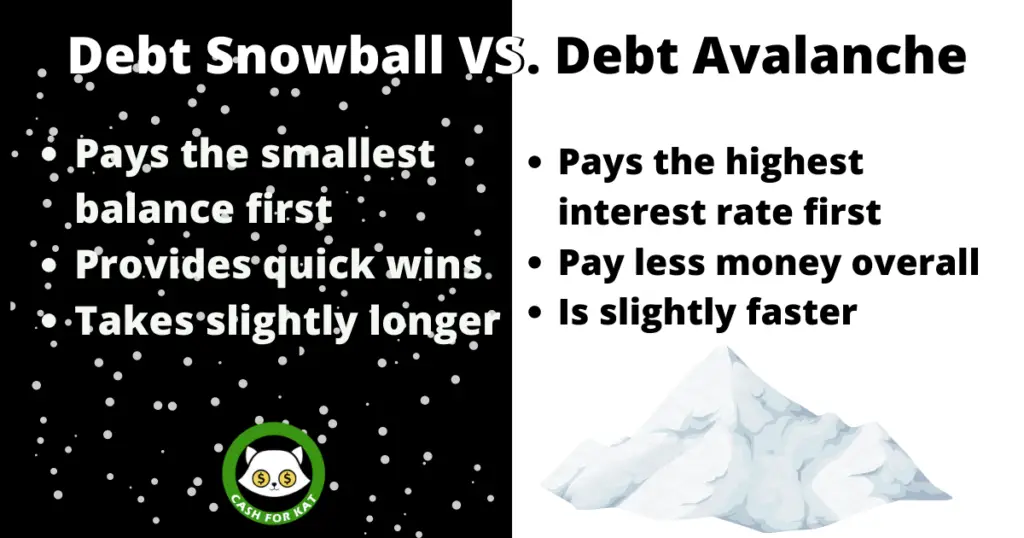

The Debt Snowball Challenge

The Debt Snowball Challenge is one of the simplest and most popular methods for paying off debt. In this challenge, all you do is list your debts in order from the smallest to the largest.

Then, you pay the minimum payments on all of your debts except for the one with the smallest balance. For that debt, you pay as much money as you can each month until it is paid off.

Once that debt is paid off, you move on to the next smallest debt and continue paying the minimums on the rest of your debts. As the snowball gains momentum (just like a metaphorical snowball going down a hill collects more snow), you will likely want to save more to speed up its journey!

This is where the Debt Snowball becomes more of a fun challenge. You can take your original pay-off timeline that is based on minimum payments and challenge yourself to do it a year or two faster.

Debt Avalanche Challenge

The Debt Avalanche Challenge is very similar to the Debt Snowball Challenge. The only difference is that you list your debts in order from the largest to the smallest.

Then, you pay the minimum payments on all of your debts except for the one with the highest interest rate. For that debt, you pay as much money as you can each month until it is paid off.

Once that debt is paid off, you move on to the next debt with the highest interest rate and continue paying the minimums on the rest of your debts. This challenge usually results in a lower overall pay-off time because you’re focused on targeting high-interest debts first.

30-Day Debt Loss Challenge from Credit Karma

The Credit Karma 30-Day Debt Loss Challenge is a great way to get motivated to pay down your debt. The premise is simple: in 30 days, you want to reduce your total combined debt by as much as possible.

They have a nice guide that gives you different action items for each day of the week. Their guide covers everything from automating savings to asking your credit card company to remove late fees. Not only is this challenge fun, but you will learn long-term healthy habits along the way!

Car Loan Payoff Challenge

The Car Loan Payoff Challenge is a great way to motivate yourself to pay down your car loan faster. The goal is simple: in a specific amount of time (usually six months to a year), you want to pay off your car loan entirely.

This challenge can be a great way to get your finances in order. Not only do you eliminate one debt, but you also free up the money you were spending on car payments each month.

This debt paydown challenge encourages you to make more than your minimum monthly payments. Not only will this help you pay off your loan faster, but you will also save money by paying less in interest!

Save $500 in a Month Challenge

This challenge is a great way to jump-start your savings. The premise is simple: in one month, you want to save $500.

Key areas you might be able to cut back on include:

- Housing costs

- Travel costs

- Food costs

These are typically the largest spending categories for most people and are the most important to keep in check. Could you rent a room out on Airbnb for a few days? Maybe switch to the bus for your commute a few times a week? Set a goal to only buy groceries at a discount?

The possible ways to win this challenge are endless. That is what makes this challenge so fun! It can be a bit of a puzzle as you find different categories of spending you can save on. In fact, I bet you can find a way to cut down on at least $50 a month!

Save $1000 a Month Challenge

This challenge can be tough, but it’s definitely achievable for most people and is a good challenge for beginners. Chances are, you can complete this challenge just by making a few lifestyle changes.

The first time I completed this challenge was during my senior year of college!! That is why I know that this challenge is possible, even if you are working with a tight budget.

This challenge is exactly as it sounds. Your only goal is to save $1,000 in a month! To get there, chances are you will have to find ways to make money outside of your 9-to-5 job.

I actually think this is part of what makes the challenge so fun! You will probably have to get out of your comfort zone and try new things in order to save money. This is also a good challenge to try for those of you who do not have an emergency fund yet!

You could try freelancing on Upwork or starting a pet sitting business, both of which can help you make a few extra hundreds within 30 days of starting. How do I know this? Because I’ve done it!

Save $10,000 in 52 Weeks

This challenge is the natural next step for those of you who have already completed the challenges above.

What makes this challenge exciting is that you are now making a lifestyle change. While the other challenges are fun, most of them can be done in 30-days. Taking on a longer savings challenge will really help those of you who are looking to tackle larger amounts of debt.

You will need to carefully consider your living expenses, increase your income, and follow a budget to accomplish this goal. It is also a good idea to find tools that can help you track your progress over time.

Of course, you can increase(or decrease) the savings amount in this challenge but 10k is a pretty good savings goal for the Average Joe! The 52-week savings challenge is a great pick no matter what country you are living in.

Another way to help you complete this challenge is to start investing, picking up some side hustles, or consider starting a business!

Challenge Your Friends

This challenge is good as a standalone or even combined with the challenges above! Just like working out, debt paydown is better when you have an accountability buddy.

You can challenge a friend (or two!) to see who can pay down the most debt in one month. The best part is, even friends who don’t have debt can participate by either saving or investing a comparable amount!

The loser (or winner!) can buy dinner as a reward. After all, having something fun to look forward to is important for motivating the group. And, at the end of the day, you will have all saved way more money than if you hadn’t done the challenge in the first place!

Debt Elimination Challenge

This challenge is the ultimate goal for anyone looking to get out of debt. This debt challenge is about more than paying down debt. It is about becoming debt-free!

The Debt Elimination Challenge is a 12-month long challenge where you and your accountability buddy work together to pay off as much debt as possible.

There are no specific rules for this challenge, but it’s important that you and your buddy are on the same page. You should figure out ways to increase your monthly debt payments, lower your interest rates, and reduce your credit card balances.

One thing to keep in mind is that you will need a plan for after the challenge is complete. Debt elimination is a great accomplishment, but it’s not the end goal! You will want to have a solid financial plan in place so you don’t fall back into debt.

Final thoughts on debt paydown challenges

Completing any of these challenges can be a great way to jumpstart your debt paydown plan. And, who knows, maybe you will even complete more than one!

The one I would recommend starting with is the Save $500 in a Month Challenge. This challenge is relatively easy to complete and can be a good starting point for those of you who are just starting to take control of your finances.

I would love to hear about your experiences in the comments below. Good luck and happy saving!

1 thought on “10 Debt Paydown Challenges (Fun!)”

Comments are closed.